hankyoreh

Links to other country sites 다른 나라 사이트 링크

Changing geopolitical order puts 20 years of Hyundai’s BRICS strategy on the rocks

Geopolitical changes including the US and China’s struggle for hegemony and Russia’s war with Ukraine are wrecking the BRICS strategy that Hyundai Motor Company has been cultivating for nearly 20 years. In the early 2000s, Hyundai built factories in the BRICS countries of Brazil, Russia, India and China, which helped propel it to the ranks of the world’s top five automakers.

When Hankyoreh reporters reviewed Hyundai’s business reports and investor briefings, they found that the percentage of overseas production sales from BRICS factories had declined precipitously over the past 10 years. In 2012, Hyundai sold a total of 2,499,098 vehicles produced overseas, with 270,167 from Brazil (10.8%), 224,598 from Russia (9.0%), 641,281 from India (25.7%) and 855,995 from China (34.3%). In short, BRICS amounted to 79.7% of the total.

Hyundai doesn’t have any factories in South Africa, the fifth country in the BRICS bloc.

Over the past 10 years, BRICS countries’ share of Hyundais’ overseas production sales has dropped by more than 20 percentage points. The automaker’s overseas production sales last year amounted to 2,245,830 units, with 53.4% (1,199,979 units) manufactured in BRICS countries.

That was led by a steep decline in the shares of Russia (2%, 44,976 units) and China (11.2%, 250,423 units). In contrast, Brazil (9%, 203,769 units) and India (31.2%, 700,811) had a similar or greater share of overseas production sales relative to 2012.

Hyundai sales in the Chinese market have been decreasing by 100,000 units every year, from 460,727 in 2020 and 368,290 in 2021 to 252,714 in 2022. The Chinese automobile market has turned sharply toward electric vehicles, and the growth of Chinese automakers has pulled the rug out from under Hyundai.

Hyundai’s plants in Russia have halted production entirely since the invasion of Ukraine in February 2022. In 2020, Russia was one of Hyundai’s main production bases, with factories there manufacturing some 210,000 vehicles. But now the company is looking into various options for those factories, including selling them off.

Local vehicle production in emerging markets, and especially BRICS countries, has been regarded as one of Hyundai’s strategies for success since the 2000s. The automaker set up shop in India in 1998, China in 2002, Russia in 2011 and Brazil in 2012, making BRICS a key component of its factory portfolio.

In effect, Hyundai was an early adopter of globalization as markets opened up around the world, including China’s admission to the World Trade Organization in 2001.

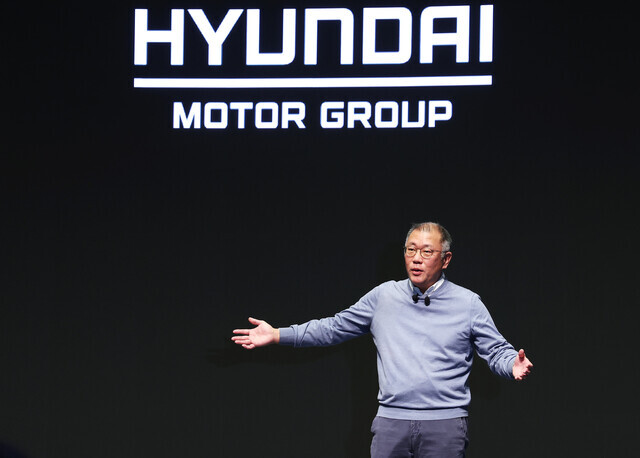

Chung Mong-koo, honorary chairman of Hyundai Motor Company, paid personal visits to factories in India and Brazil, encouraging expansion into the BRICS markets. Hyundai was thought to have become a competitive automaker with a respected brand in emerging markets, at one point holding the biggest share of the Russian market.

But with the global economic environment undergoing dramatic changes, Hyundai’s strategy appears to be changing as well. Hyundai is making big investments on electric vehicle production lines in the US in response to the US’ Inflation Reduction Act. While Hyundai is very competitive right now, the age of globalization is passing, and the US and other advanced economies are adopting protectionist industrial policies aimed at supporting domestic manufacturing.

“The BRICS economies were unstable, but high growth potential gave them value. That’s why Hyundai adopted an active localization strategy ten years ago. But ultimately it confirmed that these are risky markets, and it’s growing more dependent on the US and the EU once again,” said Cho Cheol, a senior analyst at the Korea Institute for Industrial Economics and Trade.

Hyundai is eyeing markets in Southeast Asia, and especially Vietnam. In short, it hasn’t given up its ambitions about emerging markets.

The brands with the most automobile sales in Vietnam last year were Toyota (91,115 units), Hyundai (81,582 units) and Kia (60,729 units). While Japanese companies used to dominate automobile sales in Indonesia, Hyundai has recently been expanding its presence there.

“Small gas-powered cars are still big sellers in markets in India, ASEAN, Africa, South America and Eastern Europe, and Hyundai is competitive in vehicles of that type,” said Koh Tae-bong, head of research at Hi Investment & Securities.

“Given the big changes in the market, corporate flexibility is becoming even more important than ever,” said Cho Cheol.

By Choi Woo-ri, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Does Yoon think the Korean public is wrong? [Editorial] Does Yoon think the Korean public is wrong?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/8517133419684774.jpg) [Editorial] Does Yoon think the Korean public is wrong?

[Editorial] Does Yoon think the Korean public is wrong?![[Editorial] As it bolsters its alliance with US, Japan must be accountable for past [Editorial] As it bolsters its alliance with US, Japan must be accountable for past](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0417/6817133413968321.jpg) [Editorial] As it bolsters its alliance with US, Japan must be accountable for past

[Editorial] As it bolsters its alliance with US, Japan must be accountable for past- [Guest essay] Amending the Constitution is Yoon’s key to leaving office in public’s good graces

- [Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- [Column] A death blow to Korea’s prosecutor politics

- [Correspondent’s column] The US and the end of Japanese pacifism

- [Guest essay] How Korea turned its trainee doctors into monsters

- [Guest essay] As someone who helped forge Seoul-Moscow ties, their status today troubles me

- [Editorial] Koreans sent a loud and clear message to Yoon

- [Column] In Korea’s midterm elections, it’s time for accountability

Most viewed articles

- 1[Column] The clock is ticking for Korea’s first lady

- 2Samsung barricades office as unionized workers strike for better conditions

- 3[Editorial] When the choice is kids or career, Korea will never overcome birth rate woes

- 4[News analysis] After elections, prosecutorial reform will likely make legislative agenda

- 5Why Israel isn’t hitting Iran with immediate retaliation

- 6S. Korea, Japan reaffirm commitment to strengthening trilateral ties with US

- 7[Editorial] Does Yoon think the Korean public is wrong?

- 8[Guest essay] How Korea turned its trainee doctors into monsters

- 9[Editorial] 10 years on, lessons of Sewol tragedy must never be forgotten

- 10Strong dollar isn’t all that’s pushing won exchange rate into to 1,400 range