hankyoreh

Links to other country sites 다른 나라 사이트 링크

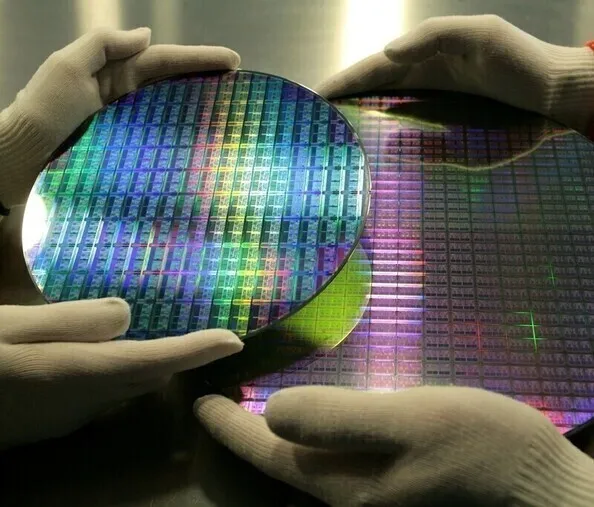

China likely to emerge as leader of next-gen power chip field in next 5-10 years, analysis shows

A new analysis shows that China could emerge as a leader in next-generation power semiconductor production in the next five to 10 years, a field of fierce competition for tech acquisition and a key area of South Korea’s “K-Semiconductor Belt Strategy.” China’s chip manufacturing competitiveness shows a two-year lag for NAND flash, and five-year lag for DRAM behind the current top manufacturers.

In its “Status of Promotion of China’s Semiconductor Localization” report released on Tuesday, the Korea Institute for International Economic Policy explained that China is pursuing support and expanding competitiveness for next-generation power semiconductors (SiC and GaN devices) used in electric vehicles and energy storage systems (ESS) in view of capturing the lead in technology.

“While various patent barriers to the manufacturing process add to China’s difficulties in overcoming technological hurdles concerning advanced semiconductors, next-generation power semiconductors can be viewed as an area that China could lead within the next five to 10 years,” the report stated.

Next-generation power semiconductors are the focus of Swiss-Italian company STMicroelectronics, which is investing US$3.2 billion to build a power semiconductor fab in the Chinese city of Chongqing by 2025.

China is focusing its investment on building up its advanced semiconductor chip design (fabless) capabilities, where the level of US sanctions against the country is relatively weak, the report said.

In fact, the number of Chinese semiconductor fabs increased by 4.1 times from 681 in 2014 to 2,810 in 2021, and fabless revenue increased by 4.3 times (to 451.9 billion yuan in 2021) during this period.

The report also highlighted the characteristics of Chinese semiconductor companies. Fabless startups such as Biren Technology have the capability to design high-performance graphics processing units (GPUs); Huawei is applying for patents in areas such as packaging (wafer-level packaging post-processing technology), extreme ultraviolet lithography (EUV), and electronic design automation (EDA); and Alibaba, ByteDance, and Tencent have begun designing AI chips.

China’s rate of localizing semiconductor equipment is also rising rapidly. As of last year, the localization rate of chip equipment in China was 35%, up 14 points in a year.

Naura Technology, AMEC, and others have been rapidly acquiring technology through government investment support and have significantly increased their localization rates in process areas such as etching, thin films, and deposition.

Meanwhile, China’s semiconductor manufacturing competitiveness is still lagging behind global leaders by about two years for NAND flash memories and five years for DRAM. The localization rate for central processing units (CPUs), DRAM, and NAND flash is still in the single digits as of 2021, according to the report.

By Cho Kye-wan, senior staff writer

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Correspondent’s column] Coupang’s game in Washington follows familiar pattern [Correspondent’s column] Coupang’s game in Washington follows familiar pattern](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2025/1226/8217667391873536.jpg) [Correspondent’s column] Coupang’s game in Washington follows familiar pattern

[Correspondent’s column] Coupang’s game in Washington follows familiar pattern![[Editorial] Coupang’s attempt to hide behind US won’t win back Korean consumers [Editorial] Coupang’s attempt to hide behind US won’t win back Korean consumers](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2025/1226/1817667387971465.jpg) [Editorial] Coupang’s attempt to hide behind US won’t win back Korean consumers

[Editorial] Coupang’s attempt to hide behind US won’t win back Korean consumers- Coupang under fire for possible obstruction of investigation into its customer data leak

- [Editorial] Coupang founder’s contempt for workers, customer security knows no bounds

- [Column] Confessions of a Coupang-holic

- [Editorial] Kim Bom-suk’s arrogance on full display in boycott of Coupang leak hearing

- [Editorial] The facts of Yoon’s insurrection are clear — justice cannot be further delayed

- [Column] Trump destroys government

- [Column] A post-Western world approaches

- [Column] Offshore balancing, or carving out spheres of influence?

Most viewed articles

- 1Korea to trial next-gen train capable of sub-2-hour Seoul-Busan trip starting 2030

- 2Kim Jong-un’s hidden motive in criticizing South Korea’s nuclear submarine push

- 3[Editorial] Coupang’s attempt to hide behind US won’t win back Korean consumers

- 4Coupang under fire for possible obstruction of investigation into its customer data leak

- 5[Correspondent’s column] Coupang’s game in Washington follows familiar pattern

- 6Real-life heroes of “A Taxi Driver” pass away without having reunited

- 7Moon Jae-in renews call for end-of-war declaration, peace treaty on Korean Peninsula

- 8Chang Chun-ha’s family hopes to know truth of his death after 37 years

- 9Chinese money flooding into South Korean companies

- 10Russian architect personally witnessed Empress Myeongseong’s assassination by Japanese ronin, accoun