hankyoreh

Links to other country sites 다른 나라 사이트 링크

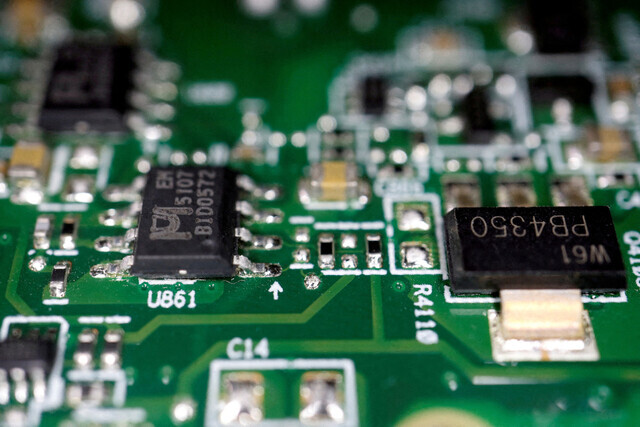

Despite chip industry slump, SK Hynix plans to spend billions on new plant in US

SK Hynix reportedly plans to build a state-of-the-art packaging plant in the US at a cost of US$4 billion.

It is one example of ongoing new investments made by the South Korean semiconductor industry amid a US strategy to internalize supply chains and intensifying competition over next-generation technology.

This is posing a considerable burden at a time when downstream industry demand has yet to fully recover. Market analysts have also predicted that the recovery in memory semiconductor industry performance will end up being slower than expected.

According to a report Wednesday in the Wall Street Journal, SK Hynix plans to spend around US$4 billion on the construction of high-tech packaging facilities in the US state of Indiana. Many of the sources cited predicted that the factory would be operational by 2028 and receive support including tax incentives based on the US’ CHIPS and Science Act.

An official with SK Hynix said that “investment in advanced packaging facilities is currently under examination” but added that “nothing has been finalized.”

Semiconductor businesses have continued their push to expand facility investment.

Samsung Electronics previously announced that it was building a foundry plant in Texas at a cost of US$17 billion. According to sources, it also mentioned the prospects of “additional investment” to the US government in recent negotiations on semiconductor subsidies.

Plans are also underway to increase facility investment for the high-bandwidth memory (HBM) used in artificial intelligence by 2.5 times this year compared with 2023 levels. It is a case where the US strategy for internalizing supply chains has combined with stiffening competition in the wake of the AI trend to pose a growing investment burden on companies.

Some of the companies are already feeling the strain. Their fear is that the massive increase in investment at a time when business conditions have yet to fully recover could end up jeopardizing financial soundness.

At a shareholders’ meeting Wednesday, SK Hynix CEO Kwak Noh-jung said the plan was to “formulate and abide by capex [capital expenditure] rules based on current year sales value.”

“We intend to avoid excessive outlays on capex in favor of boosting our cash level and improving financial soundness,” he said.

Also worrying is the fact that many analysts are predicting a slow recovery in IT demand in the near future. On Tuesday, the market research provider TrendForce said the rate of increase in DRAM prices was expected to drop from as high as 23% in the first quarter of 2024 to between 3% and 8% in the second. This was based on the fact that smartphone demand has yet to show a significant recovery, while the generational shift to DDR5 in the server market has been slower than expected.

Market observers are also predicting that memory semiconductor industry performance is unlikely to improve substantially for the time being.

“What’s needed more to really improve memory semiconductor business conditions is demand for the chips used in traditional IT areas such as mobile communications, PCs and general purpose services [rather than HBM],” Nice Investors Service advised on Tuesday.

Due to macroeconomic factors restricting consumption, it predicted, “the rate of business condition improvements appears likely to be gradual.”

The semiconductor industry is pinning its hopes on a greater role for high-performance semiconductors. The expectation is that as AI demand continues to grow and high-value-added items such as HBM come to represent a larger portion of sales, this will work to offset other detrimental factors.

Kwak said, “Out of all our current DRAM sales volume, HMB bits have represented a single-digit percentage.”

“That is going to increase to double digits this year, which I think will help in terms of profitability,” the SK Hynix CEO added.

By Lee Jae-yeon, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 3[Column] Season 2 of special prosecutor probe may be coming to Korea soon

- 4Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 5Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 6[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 7[Special report- Part III] Curses, verbal abuse, and impossible quotas

- 8Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 9S. Korea “monitoring developments” after report of secret Chinese police station in Seoul

- 10The dream K-drama boyfriend stealing hearts and screens in Japan