hankyoreh

Links to other country sites 다른 나라 사이트 링크

Exchange rate, oil prices, inflation: Can Korea overcome an economic triple whammy?

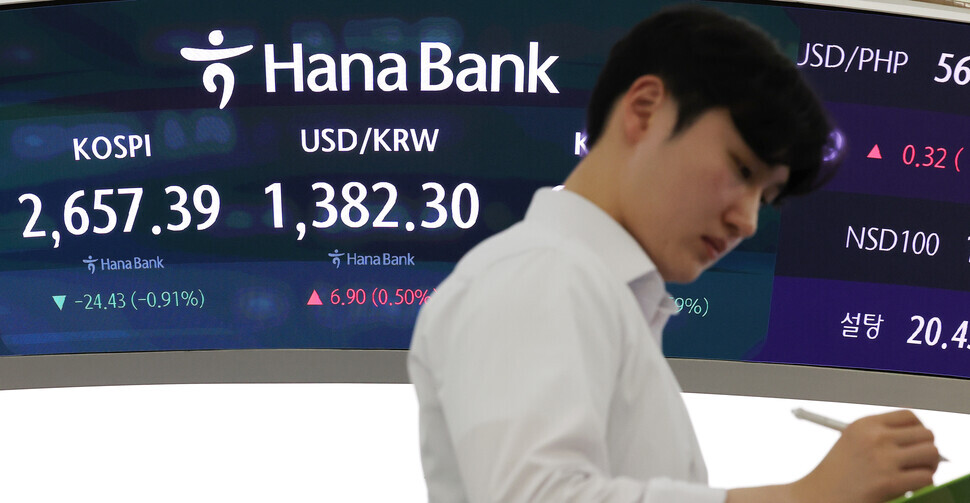

The price of Dubai crude oil is set to top US$100 per barrel, while Korea’s exchange rate is closing in on 1,400 won to the US dollar.

The situation is amplifying upward pressure on prices in the country, which were already showing uncertainty with sharply rising costs for agricultural products. Meanwhile, the US’ unexpectedly strong economic resilience has reduced the chances of it lowering its policy interest rate — raising the specter of high interest rates and high prices carrying on into the long term.

South Korea’s economic worries are also being compounded by growing geopolitical uncertainties, including the escalating conflict between Iran and Israel.

Everything about the situation has defied the overall predictions of the South Korean government in late 2023 and early 2024. For instance, the administration predicted this year’s average Dubai oil price would remain around US$81, while anticipating that the rate of increase in consumer prices would level off in the 2%–3% range during the first half of the year.

There’s a consensus among experts that Korea needs to rework economic policies in a way that takes the new domestic and external environments into account. In particular, these experts are calling on the government to play an active fiscal role to support segments of the population that are vulnerable to the risks associated with high prices and interest rates.

Sky-high international oil prices and exchange rates: A shifting landscape

Prices are poised to exceed US$90 per barrel for West Texas Intermediate, one of the three major crude oils. After climbing as high as U$95 in late September 2023, the price per barrel dropped below US$80 by the end of the year. Since the start of 2024, it has shown a steep upward curve.

The situation reflects factors including the global trend of economic recovery, uncertainties surrounding the Middle East, and speculative demand. The price of Dubai crude oil, which is one of the varieties imported by South Korea, has already passed US$90 per barrel and is poised to reach the US$100 mark. Since the start of 2024, the Dubai crude price has jumped by 15.1%.

The won-to-dollar exchange rate has been showing a consistent trend of increase since the second quarter of 2022, when the current administration in Seoul took office. Recently, the rate has been climbing particularly sharply.

This rate rose 26 won in seven trading days to 1,375.4 won per dollar on Friday. Considering that it was 1,270 won per dollar at the beginning of this year, the rate of increase within the past three or so months is nothing to laugh at. The average exchange rate for the first quarter of this year is the second highest after the 2008 financial crisis.

High oil prices and a high exchange rate both contribute to an increase in the cost of producing goods, fanning anxiety over inflation. Since these factors also cut into corporate profits, they also increase the risk of bankruptcy while leading to a contraction in wages and hiring.

The situation is a far cry from government predictions at the end of last year and at the beginning of 2024. The South Korean government forecast that exports would lead the way to an economic recovery and that inflation would gradually subside to around 2% during the first half of 2024. The administration also leaned on hopes that the Fed in the US would start cutting interest rates around June, which would allow the Bank of Korea to lower interest rates in the second half of the year.

In this scenario, the government would focus its fiscal resources on the country’s construction industry to facilitate growth. It would also revise monetary policy in the second half of the year to compensate for fiscal shortages and other economic side effects. This is all laid out in the Ministry of Economy and Finance’s “2024 Economic Policy Directions” document.

Economic policy needs to be adjusted according to shifting environment

While the export sector has quickly recovered, domestic demand has not, and the disparity is getting worse. Exports of specific products like semiconductors have increased at an unexpected rate, but such increases are not being felt in the wider economy. High interest rates and inflation have stretched into the long term, increasing the likelihood that we’ll see a delay in the recovery of domestic consumption. Statistics Korea’s retail sales index (adjusted seasonally) is an officially used measure to gauge the robustness of domestic consumption. This past February, the retail sales index dropped to its lowest level in 39 months. In March, hiring increased at the smallest margin in three years.

Experts are calling for foundational adjustments to Korea’s economic policy. Both the internal and external economic situations have defied prior predictions, and policies must be adjusted to reflect these shifts and manage risk. Many are calling for increased support for groups that are particularly vulnerable to high interest rates and inflation. There is also a growing faction that advocates for an exit from austerity measures centered around lower taxation and decreased spending.

“The current administration has exhausted all economic recovery measures outside of increased spending, and they’ve all been ineffective,” said Kim Yu-chan, the president of the Inclusive Public Finance Forum.

“The government must increase its spending to revitalize the economy. It needs to adopt a flexible fiscal approach that focuses on fiscal integrity after the economy starts recovering again,” Kim added.

Some are calling for giving hefty financial support to people in lower income brackets.

“Lowering taxes only benefits those who are economically capable of paying taxes. If we’re in a situation that necessitates high interest rates to battle inflation, then we need increased fiscal support for vulnerable classes and income brackets,” said Woo Seok-jin, a professor of economics at Myongji University.

“To accumulate the necessary resources and revenue, there is the option of ceasing the current measures of lowering taxes and increasing taxes for those who can afford to pay them,” Woo said.

By Ahn Tae-ho, staff reporter; Park Su-ji, staff reporter; Choi Ha-yan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 3Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 4Gangnam murderer says he killed “because women have always ignored me”

- 5South Korea officially an aged society just 17 years after becoming aging society

- 6BTS says it wants to continue to “speak out against anti-Asian hate”

- 7After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 8No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 9Ethnic Koreans in Japan's Utoro village wait for Seoul's help

- 10US citizens send letter demanding punishment of LKP members who deny Gwangju Massacre