hankyoreh

Links to other country sites 다른 나라 사이트 링크

South Korea a veritable tax break paradise for chaebol

By Ryu Yi-geun, staff reporter

In May 2013, Apple CEO Tim Cook testified before Congress. Apple, the largest company in the US, was suspected of tax evasion. The Senate’s Permanent Subcommittee on Investigations (PSI) accused Cook of hardly paying any taxes on the US$74 billion that Apple earned overseas in the four years since 2009.

For example, Apple subsidiary Apple Operations International - based in Ireland, a tax shelter - earned US$30 billion during this period, but it did not pay a penny in corporate taxes. Cook responded to the senators’ questions by insisting that Apple had paid taxes in accordance with the laws in the US and other countries.

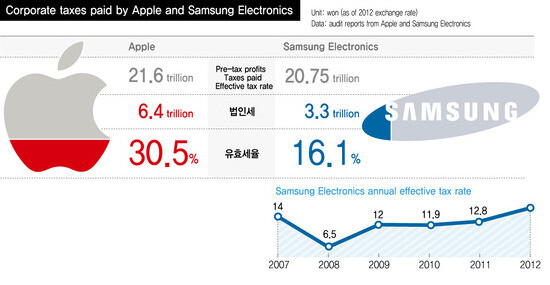

In fact, Cook turned the tables by making a request to Congress. Suggesting that the maximum corporate tax rate of 35% (39.2% including local taxes) is too high, he asked lawmakers to lower the tax rate to the mid-20% range. He also stressed that Apple had paid US$6 billion in taxes on the US$19.7 billion in profits on sales of the iPhone and other products in the US in 2012 alone. Apple’s effective tax rate is 30.5%.

Effective tax rate, which refers to tax as a percentage of a company’s profits, is calculated by dividing taxes paid by taxable income. The lower the effective tax rate, the less tax a company pays.

What Cook wants is already a reality in South Korea. The maximum corporate tax rate in South Korea is 22% (24.2% including local taxes), even lower than what Cook asked US Congress for. The rival of Apple, the world’s number-one company in terms of total stock value, is Samsung Electronics, the largest company in South Korea. So just how much of its profits is Samsung Electronics paying in tax?

In 2012, Samsung had 20.75 trillion won in profits and paid 3.35 trillion won in taxes (figures taken from reports from auditors and individual businesses). The effective tax rate disclosed by Samsung is only 16.1%.

To be sure, this is the amount of corporate tax based on accounting standards, which excludes overseas corporations; it is not the amount that Samsung actually paid the National Tax Service (NTS). Still, Samsung’s tax burden is about half of Apple’s.

In the US, the CEO of the country’s largest company was summoned to a congressional hearing and asked whether the company is paying the taxes it owes at home and abroad. This situation is unlikely to happen in South Korea.

The single biggest reason that Samsung has a smaller tax burden than Apple is that South Korea’s maximum corporate tax rate is much lower than the US’s. The maximum corporate tax rate in South Korea is lower than the OECD average, which is 25.6% including local taxes.

The second reason is that Samsung enjoys more tax exemptions and breaks than Apple. Including local taxes, Samsung’s effective tax rate is 67% of the maximum tax rate, while Apple’s effective tax rate is 78%. The amount of tax exemptions exceeds the gap in the maximum tax rate between South Korea and the US, further widening the gap in tax burden between Samsung and Apple. The tax breaks that Samsung enjoyed in 2012 (exemptions in terms of accounting) totaled 1.87 trillion won, more than half of its corporate taxes for the year.

The tax breaks enjoyed by Samsung are even larger than its tax burden. In the 2011 fiscal year (filed with the NTS in 2012), Samsung received 13.9% of all exemptions and reductions in corporate tax in South Korea. In contrast, Samsung only paid 3% of total corporate taxes. This gives the lie to the argument that it is only natural for Samsung to receive more tax breaks since it pays more taxes.

The percentage of profit that Samsung pays as taxes is also lower than other companies in South Korea.

An analysis of the NTS’s yearly national tax report and data received from the NTS by Democratic Party lawmaker Hong Jong-hak indicates that the average effective tax rate (total tax payable divided by tax base) for 480,000 South Korean companies was 16.8%.

Tax base refers to the income or earnings according to which taxes are calculated, while total tax payable means the actual taxes that are filed with the NTS.

During the same year, the effective tax rate (the amount of corporate tax divided by pretax profit at Samsung in terms of accounting) was 12.8%, lower than the average of all the companies. The effective tax rate (in terms of accounting) at 310,000 ordinary corporations (excluding financial, insurance, and securities companies) reached 19%. The effective tax rate at Samsung is less than the average rate of 13.3% at small and medium-sized companies (based on what they filed with the NTS).

The low ratio of taxes to earnings is not just a problem at Samsung. At the highest-earning corporations in South Korea, corporate taxes on earnings start to taper off above a certain amount.

Fundamentally, corporate tax is just like income tax in that it is progressive: the more a company makes, the higher the tax rate it must pay. For example, if an SME that makes 100 million won has to pay 10%, or 10 million won in taxes, a chaebol earning 1 trillion won might have to pay 15%, or 150 million won.

But the average effective tax rate at South Korea’s chaebol (conglomerates that are legally prohibited from cross-investing) is 16.2%, which means their tax burden is lower than the average of all corporations. 1,539 companies belong to these chaebol, accounting for 0.3% of all taxable corporations.

One noteworthy thing is that a company’s proportional tax burden decreases as its wealth increases, even among this small group of companies that are part of South Korea’s chaebol. The average effective tax rate is 20.6% at companies ranked 30-39, 16.6% at companies ranked 20-29, and 15.2% at companies ranked 10-19.

The reason for this is that tax breaks are concentrated among the richest companies. 58.6% of total tax breaks on corporate taxes (or 50.8% excluding exemptions on taxes paid overseas) go to subsidiaries of South Korea’s chaebol. The tax benefits enjoyed by South Korea’s top 10 chaebol alone, including Samsung, Hyundai Motor, SK, LG, and Lotte, amount to 47.7%, nearly half of the total.

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol![[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/7317139454662664.jpg) [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

- [Editorial] Does Yoon think the Korean public is wrong?

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Will NewJeans end up collateral damage in internal feud at K-pop juggernaut Hybe?

- 3[Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- 4Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 5Thursday to mark start of resignations by senior doctors amid standoff with government

- 6N. Korean hackers breached 10 defense contractors in South for months, police say

- 7[Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- 8[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 9Kim Jong-un expressed ‘satisfaction’ with nuclear counterstrike drill directed at South

- 10[Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent