hankyoreh

Links to other country sites 다른 나라 사이트 링크

Mistake or deliberate ruse? S. Korea misquotes OECD debt data

The Ministry of Strategy and Planning misquoted OECD statistics used for comparison when assessing South Korea’s fiscal soundness, it was confirmed on Aug. 17.

The discovery has led to worries that the administration may have taken a step too far by distorting an international body’s figures in order to tout its own abundant fiscal resources.

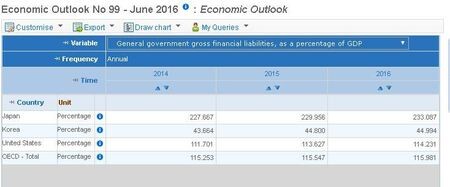

A visit to the OECD economic statistics system by the Hankyoreh on Aug. 17 showed the average general government debt-to-GDP ratios for OECD members at 84.1% for 2014 and 88.3% for 2015. Basic data for the calculation were taken from figures in a World Economic Outlook report published by the OECD in June. The same report is used by the South Korean government for national comparisons.

But the numbers differ substantially from the average OECD national debt-to-GDP ratio figures presented by the Ministry of Strategy and Finance in various press releases and talks with reporters. Explanatory data issued by the ministry in November and a press release on the OECD fiscal report both gave a 2015 average OECD national debt-to-GDP ratio of around 115%.

The discrepancy stemmed from the ministry’s misquoting the data. Specifically, the OECD gave a “total” national debt-to-GDP ratio in its World Economic Outlook report, which the ministry mistakenly presented as an average for all OECD members. The metric, which calculates a total debt ratio as if the OECD were a single country, is of a completely different meaning and character from the average ratio for OECD members.

While the ministry claimed this was a “staff error,” it may have been deliberate.

“It’s tough to understand how [financial authorities] could have failed to tell the difference between an average and a total,” said a university professor of finance on condition of anonymity. “You get the sense the mistake was a result of trying to emphasize our fiscal capacity.”

Even if it was a simple mistake, the use of a total rather than an average national debt ratio has major ramifications: an overly rosy assessment of fiscal soundness could lead to unwise financial management.

To begin with, the total debt ratio, which treats the OECD as a single country, is heavily influenced by changes in countries with large debt loads. Indeed, while both the average and total national debt ratio indicators rose for the OECD in the wake of the 2008 financial crisis, the scale of increase was very different: the average for member countries jumped by 32.5 percentage points from 55.8% to 88.3% between 2007 and 2015, while the OECD total for the period increased by 41 percentage points from 74.5% to 115.5%. The difference stemmed from a major increase in national debt for certain member countries with large amounts of it - especially Japan, the US, the United Kingdom, and France. Indeed, the debt ratios for Japan and the US rose by 67.6 and 48.7 percentage points respectively over the period in question.

“Usually, the goal of using an international organization’s statistics as a yardstick is to compare individual countries‘ fiscal management conditions with our own,” said Myongji University economics professor Woo Seok-jin.

“In that sense, the appropriate measure for comparison would be the OECD average national debt-to-GDP ratio rather than the total, which is a basic indicator for assessments when formulating fiscal management strategy,” Woo added.

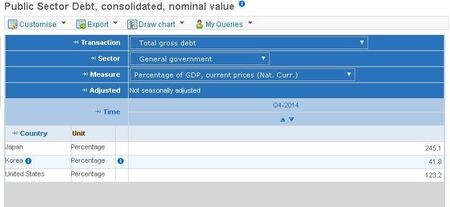

Signs even point to the ministry making arbitrary use of OECD financial statistics. In mentioning the OECD average debt ratio, the ministry used data from the OECD’s World Economic Outlook report. But when it has to actually present country-by-country debt ratios - as with its monthly “Financial Trends” publication - it cites National Accounts Statistics compiled by the OECD. While the National Account Statistics simply list the information reported by each member country, the World Economic Outlook differs from it by offering reprocessed indicators based on both the information presented by the countries as well as information identified by the OECD secretariat.

The interesting thing is the large discrepancy between South Korea’s debt ratios as listed in the National Accounts Statistics and the World Economic Outlook report. According to the former, South Korea’s debt ratio stood at 41.8% in 2014; in the latter, it was given as 43.7%. As a result, the ministry is effectively citing the National Accounts Statistics and its lower debt ratio for South Korea, while using the World Economic Outlook report for the purpose of comparison.

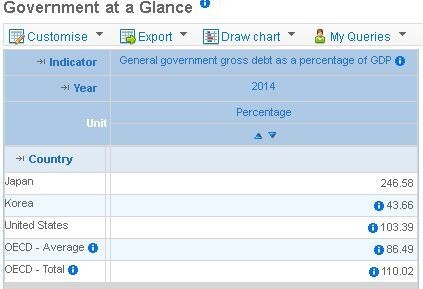

Unlike the South Korean government, the OECD doesn’t use either the World Economic Outlook or the National Accounts Statistics as its first official standard when comparing countries’ national debt. Instead, its standard when presenting debt ratios for individual countries in the “Government at a Glance” report, published every year on a separate statistics site (dara.oecd.org) developed for ease of viewing by investors and members of the public. That report listed South Korea’s debt ratio for 2014 at 43.7% and the OECD average at 86.5%. The South Korean government does not share the OECD’s leading statistic for national debt ratio comparison at home or cite it in government-published materials.

By Kim Kyung-rok, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0517/8117159322045222.jpg) [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later

[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later![[Column] When ‘fairness’ means hate and violence [Column] When ‘fairness’ means hate and violence](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/7417158465908824.jpg) [Column] When ‘fairness’ means hate and violence

[Column] When ‘fairness’ means hate and violence- [Editorial] Yoon must stop abusing authority to shield himself from investigation

- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

Most viewed articles

- 1[Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- 2For new generation of Chinese artists, discontent is disobedience

- 3[Column] US troop withdrawal from Korea could be the Acheson Line all over

- 4[Exclusive] Unearthed memo suggests Gwangju Uprising missing may have been cremated

- 5[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner t

- 6Xi, Putin ‘oppose acts of military intimidation’ against N. Korea by US in joint statement

- 7Celine Song says she’s gratified global audiences have responded to the kismet of ‘inyeon’

- 8Could Korea’s Naver lose control of Line to Japan?

- 9China, Russia put foot down on US moves in Asia, ratchet up solidarity with N. Korea

- 10Yoon ridicules critics of Fukushima dumping in first comments since release began