hankyoreh

Links to other country sites 다른 나라 사이트 링크

Samsung Electronics records $171.5 billion in sales for fifth straight year

Samsung Electronics recorded 200 trillion won (US$171.5 billion) in sales for five straight years, racking up record performance in its semiconductor sector on a quarterly basis. It has also begun returning profits to shareholders in earnest through bigger dividends and purchasing and retirement of treasury stock.

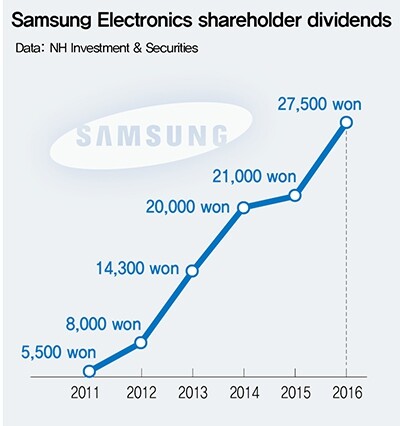

On Jan. 24, the company purchased and retired 9.3 trillion won (US$8 billion) in treasury stock, while approving end-of-year dividends of 3.8503 trillion won (US$3.3 billion) for 2016. The treasury stock purchase includes 8.5 trillion won (US$7.3 billion) remaining from last year‘s shareholder rewards and 800 billion won (US$686 million) in residual finances from 2015. Shareholder dividends amount to 27,500 won (US$23.58) for common stocks and 27,550 won (US$23.62) for preferred stocks, with 2016 dividend values per stock (including interim dividends) up around 36% from 2015.

Samsung Electronics shareholder dividends have been increasing steadily. Since the 2011 allocation of 5,500 won (US$4.72) per stock, the value has risen to 27,500 won for 2016, quintupling in the space of six years. Chairman Lee Kun-hee, who owns a 3.54% share, made 137.1 billion won (US$117.6 million); son and Vice Chairman Lee Jae-yong, who owns 0.6%, made 23.1 billion won (US$19.8 million).

The large-scale retirement of treasury stock, which has a similar shareholder value boosting effect on dividends, was intended as a move to appease foreign shareholders and other investors. In response to an open letter last year from a hedge fund associated with the US’s Elliott Management demanding a 30 trillion won (US$25.7 billion) cash payout in dividends,

Samsung Electronics announced that it would commit 50% of its surplus cash flow for 2016-17 to shareholder rewards.

“Samsung Electronics’s sales haven’t risen since reaching 200 trillion won in 2012,” said IBK Securities analyst Lee Seung-woo.

“It was called the ‘Samsung approach’ to grow through investment rather than dividends, but overseas shareholders who were disappointed with the lack of sales growth began strongly demanding rewards,” Lee explained.

In 2012, Samsung Electronics told securities companies it planned to achieve 400 trillion won (US$343 billion) in sales by 2020.

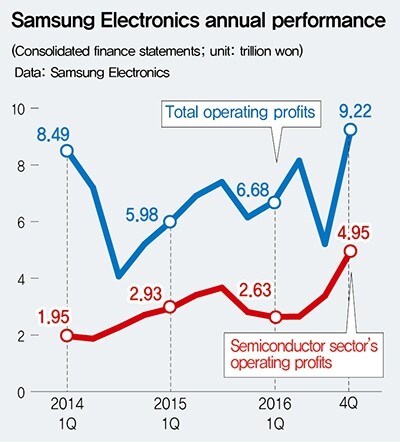

But a 2016 business performance report on Jan. 4 showed the company hoisting itself up to the 200 million won mark in sales thanks to strong performance in its semiconductor sector. For the fourth quarter of 2016 (consolidated), it achieved sales of 53.33 trillion won (US$45.7 billion) and operating profits of 9.22 trillion won (US$7.9 billion); for the year, it recorded 201.87 trillion won (US$173.1 billion) in sales and 29.24 trillion won (US$25.1 billion) in operating profits. For the fourth quarter, the company announced that it had achieved 14.86 trillion won (US$12.7 billion) in sales and 4.95 trillion won (US$4.2 billion) in operating profits for its semiconductor sector as increased supplies of high-performance, high-capacity products propelled growth in the memory area. The historically high quarterly performance in semiconductors means the sector has made up for the discontinuation of the Galaxy Note 7 smartphone.

Semiconductor demand rose sharply last year as the AlphaGo computer program’s victory over Go grandmaster Lee Se-dol and the emergence of artificial intelligence and Big Data as industry themes spurred increased investment.

“Semiconductors had entered a cycle of decline as global business conditions waned, but since the second half of 2016 the performance has surpassed expectations to an almost startling degree,” said Lee Seung-woo.

The numbers mean that despite the blow from the Galaxy Note 7 recall and discontinuation, Samsung Electronics has reaped rich rewards from the so-called “AlphaGo effect.”

But the company has also reportedly been hesitant to invest more in its semiconductors. Facility investment last year amounted to 25.5 trillion won (US$21.9 billion), which was less than the initially planned 27 trillion won (US$23.2 billion).

“There’s been a company-wide sense of concern about issues like the Galaxy Note 7 fires, and it looks like they’re increasing profitability without any increase in facility investment from 2016, even if it means losing DRAM market share,” said Samsung Securities analyst Hwang Min-sung.

Meanwhile, Samsung SDI, which supplied the batteries responsible for the Note 7 fires, had an estimated 5.2008 trillion won (US$4.46 billion) in sales for 2016, down 31.3% from 2015. Its operating losses amounted to 926.3 billion won (US$794.3 million), an increase of 15.5 times from the 59.8 billion won (US$51.3 million) recorded for the year before.

By Lee Wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Samsung Electronics annual performance Data: Samsung Electronics (Consolidated finance statements; unit: trillion won)

Samsung Electronics shareholder dividends Data: NH Investment & Securities

Editorial・opinion

![[Editorial] Exploiting foreign domestic workers won’t solve Korea’s birth rate problem [Editorial] Exploiting foreign domestic workers won’t solve Korea’s birth rate problem](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0626/5517193887628759.jpg) [Editorial] Exploiting foreign domestic workers won’t solve Korea’s birth rate problem

[Editorial] Exploiting foreign domestic workers won’t solve Korea’s birth rate problem![[Column] Kim and Putin’s new world order [Column] Kim and Putin’s new world order](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0625/9617193034806503.jpg) [Column] Kim and Putin’s new world order

[Column] Kim and Putin’s new world order- [Editorial] Workplace hazards can be prevented — why weren’t they this time?

- [Editorial] Seoul failed to use diplomacy with Moscow — now it’s resorting to threats

- [Column] Balloons, drones, wiretapping… Yongsan’s got it all!

- [Editorial] It’s time for us all to rethink our approach to North Korea

- [Column] Why empty gestures matter more than ever

- [Editorial] Seoul’s part in N. Korea, Russia upgrading ties to a ‘strategic partnership’

- [Column] The tragedy of Korea’s perpetually self-sabotaging diplomacy with Japan

- [Column] Moon Jae-in’s defense doublethink

Most viewed articles

- 1CIA record confirms US ‘completely destroyed’ Seoul’s Haebangchon in 1950 bombardment

- 2Dispatched into unknown danger, foreign day laborers were defenseless against blaze

- 3Blaze at lithium battery plant in Korea leaves over 20 dead

- 4How 17 km of river could be a fertile bed for NK-China-Russia cooperation

- 5[Editorial] Exploiting foreign domestic workers won’t solve Korea’s birth rate problem

- 6Three expert views of the war in Gaza: From a Hamas official to Israel’s ambassador in Seoul

- 7North Korea sends trash balloons into South for second straight night

- 8[Editorial] Workplace hazards can be prevented — why weren’t they this time?

- 9North Korea, Russia are going backward into history, Yoon says of new defense pact

- 10How sanctions are backfiring to fuel a new Eurasian alliance