hankyoreh

Links to other country sites 다른 나라 사이트 링크

[Column] Will Tesla follow the same pattern as Cisco?

Is there something wrong with doubting Tesla?

I’m talking about Tesla stock, not Tesla as a manufacturer of electric vehicles. At the end of last year, Tesla stock was selling for US$50 a share; recently, it peaked at US$500. In short, Tesla is a ten-bagger, its stock multiplying by 10 times in less than a year. It’s a truism that people flock to a hot stock, and South Korean investors have been busily buying up Tesla stock, acquiring a value of 4 trillion won (US$3.38 billion) so far.

In the market, there’s a sense that it’s only natural for tech stocks to soar because they’re grounded in strong performance. A contrast is drawn with the dot-com bubble in 2000, when there was no substance to back up the exuberance.

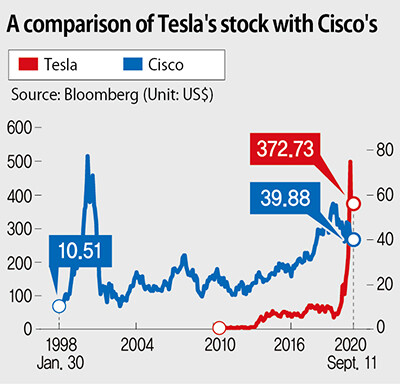

But that analysis only holds water if we compare ordinary companies in 2000 to the best-performing companies today; things look a lot different in a fairer comparison with the finest companies of the past. The top stocks in the US in 2000 were Cisco, Intel, Oracle, and Microsoft. They were the market leaders in 2000, just as Facebook, Amazon, Apple, Netflix, and Google (known by the acronym “FAANG”) propel the Nasdaq Composite today.

Back then, Cisco Systems was the pride of Wall Street, praised as the finest company ever created. Cisco was adept at acquiring operations it needed and making them its own. Because it was making equipment needed for internet connections with proprietary technology, its future couldn’t have been brighter.

But that didn’t stop the market crash. Cisco stock, which had been worth US$78 a share just before the bubble burst, tumbled nearly 80% over the next year, to US$17. Even a highly profitable company with the biggest market capitalization in the world couldn’t prop up its high stock price. Today, Cisco stocks are worth about half of what they were two decades ago. Intel hasn’t been able to return to its old peak either. Microsoft is worth much more now than it used to be, but it took 16 years to recover 2000 levels.

What’s taken for gospel truth today may not seem so certain in the future. There’s no way to know whether the belief that Tesla will dominate the world of electric vehicles will seem so obvious five years hence. It would be even more rash to assume that its stock price will pull off another tenfold increase.

The Nasdaq has passed through four bull markets since the financial crisis to bring it to its current level. In the first boom, the index started at 1300 and rose by 117% over two years. In the second boom, the index rose 120% over the course of four years. In the third boom, the index began at 4300 and rose 88% to 8100. And in the fourth boom, the one we’re in right now, the index has climbed 83% in six months. While some say that the index is simply bouncing back from COVID-19, similar conditions were in play in the past. Since stocks have soared so quickly, there would be nothing unusual about a correction.

Over the past two days, Nasdaq stocks have seen extreme turbulence, dropping by 10% during trading. A Nasdaq downturn would have broader reverberations, however, extending beyond that single exchange. The Nasdaq has stayed bullish even as markets in other advanced countries other than the US have languished in the doldrums. Investors assume the Nasdaq is rising because of factors in the US economy; if the US economy is fine, they think, their own economies will also improve with time. But now eyes are turning to the Nasdaq once more — this time, because of the possibility that it will fall.

By Lee Jong-woo, financial columnist

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0502/1817146398095106.jpg) [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

Most viewed articles

- 160% of young Koreans see no need to have kids after marriage

- 2Presidential office warns of veto in response to opposition passing special counsel probe act

- 3S. Korea “monitoring developments” after report of secret Chinese police station in Seoul

- 4Months and months of overdue wages are pushing migrant workers in Korea into debt

- 5Hybe-Ador dispute shines light on pervasive issues behind K-pop’s tidy facade

- 6[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- 7OECD upgrades Korea’s growth forecast from 2.2% to 2.6%

- 8Inside the law for a special counsel probe over a Korean Marine’s death

- 9Japan says it’s not pressuring Naver to sell Line, but Korean insiders say otherwise

- 10[Exclusive] Hanshin University deported 22 Uzbeks in manner that felt like abduction, students say