hankyoreh

Links to other country sites 다른 나라 사이트 링크

K-pop a major contributor to boom in physical album sales worldwide, says IFPI analyst

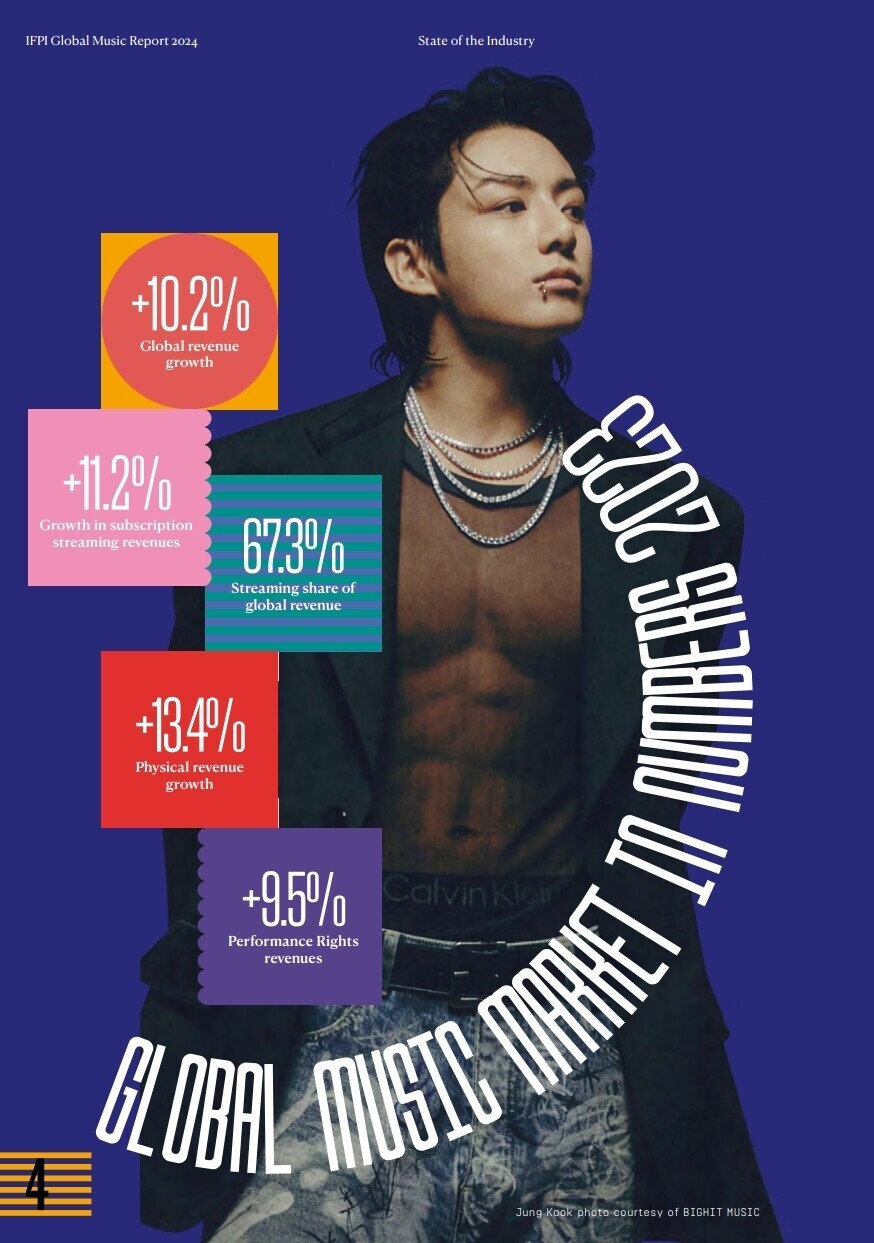

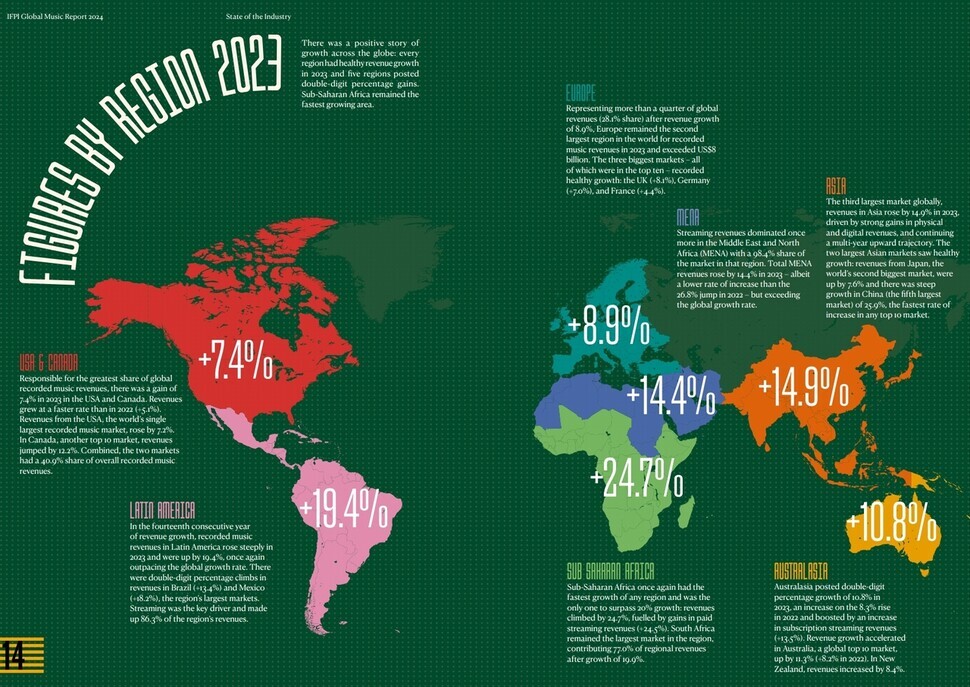

The global recording industry grew by 10.2% in 2023, with subscription-based streaming and physical album sales growing by 11.2% and 13.4%, respectively.

The figures appeared in a recent report by the International Federation of the Phonographic Industry. The IFPI, whose membership includes over 8,000 record companies around the world, publishes a yearly report covering trends in the global recording industry.

One especially notable part of the report was the exceptional showing by K-pop acts. In a global album chart tracking last year’s top-selling albums, K-pop albums occupied five of the top 10 spots, including “FML” by Seventeen (No. 1), “5-Star” by Stray Kids (No. 2), and “ISTJ” by NCT Dream (No. 6). And four K-pop acts were among the top ten entries in the global artist chart: Seventeen (No. 2), Stray Kids (No. 3), Tomorrow X Together (No. 7) and New Jeans (No. 8).

What does the IFPI think about those results? The Hankyoreh posed that question to Lewis Morrison, IFPI’s director of global data and analysis, during a video interview on Thursday. Morrison, who is based in the London main office, was visiting a branch in Singapore.

Morrison said the global recording industry has unexpectedly sustained double-digit growth over the past few years. The streaming market led growth overall, with K-pop accounting for a large share of growth in the physical album market.

Physical albums used to dominate the market, but now streaming accounts for 67.3% of sales. There was a sharp decline in the physical album market in the 2010s, but that has rebounded over the past couple of years.

With demand for LPs surging, Morrison said, not only older bands like Pink Floyd but also young artists such as Olivia Rodrigo and Billie Eilish are releasing albums on vinyl. The spread of the K-pop fandom into North and South America has driven up record sales, and Taylor Swift has had a huge impact as well.

Such factors, he noted, are why the physical album market is still growing even in the age of streaming.

Morrison recognized K-pop’s positive impact on the global recording industry. He noted that in 2019, there was just one K-pop album with more than a million sales, but last year, there were 35 albums that hit the million mark. According to Morrison, BTS paved the way, and other capable and talented artists have followed in their footsteps.

An effective strategy for K-pop labels, Morrison explained, has been making aggressive investments and forging partnerships with global labels. Another big factor is that the development of the internet and social media makes it increasingly easy to encounter K-pop anywhere in the world.

Morrison thinks K-pop has a bright future in the global market. He admitted to having doubts about whether K-pop could sustain its growth while the BTS members were on hiatus to complete their military service. But a steady stream of outstanding artists like Seventeen have risen to the top of the charts since then, convincing him that K-pop will keep growing. He also sees more opportunities through partnerships with global labels.

But certain conditions are needed for K-pop’s continuing growth, stressed Um Tae-jin, Korea consultant for the IFPI, who was also present for the video interview.

“K-pop has been a pillar of Hallyu exports. But if K-pop is to keep developing as an industry, Korea also needs to make institutional and policy changes to protect copyright and creators’ rights,” Um said.

Um made note of AI, which has been in the spotlight lately. “We need to require that [AI companies] receive permission from rights holders before using musical compositions in AI learning and demand transparency about what data they’re using,” he said.

Morrison noted that there are sure to be future obstacles to growth in the recording industry, including K-pop. But he promised that the IFPI would keep monitoring trends to support the music ecosystem’s continuing development.

By Suh Jung-min, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 2‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 3After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 4Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 5BTS says it wants to continue to “speak out against anti-Asian hate”

- 6AI is catching up with humans at a ‘shocking’ rate

- 7Noting shared ‘values,’ Korea hints at passport-free travel with Japan

- 846% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 9Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 10Ethnic Koreans in Japan's Utoro village wait for Seoul's help