hankyoreh

Links to other country sites 다른 나라 사이트 링크

Rising prices in China, US add to global inflation fears

Producer prices in China, the world’s biggest exporter of consumer goods, are hitting record levels, even as consumer prices continue to soar in the US, the world’s biggest importer. Conditions in the world’s two biggest economies are casting dark shadows of inflation on the global economy.

In a report on September price trends released on Thursday, China’s statistics bureau reported that producer prices last month were up 10.7% from the same month a year ago. That bumped up August’s increase of 9.5% and represented the highest jump since China began tracking the figure in 1996. China’s National Bureau of Statistics explained that prices were steeply rising in areas that are heavily reliant on energy, including coal, which has become more expensive than ever before.

On Wednesday, the US Department of Labor reported that US consumer prices in September rose by 5.4% from the same month last year. That was the same rate as the increase in June and July, representing the highest level since 2008. That’s reinforcing predictions that it won’t be easy to curb inflation for the time being.

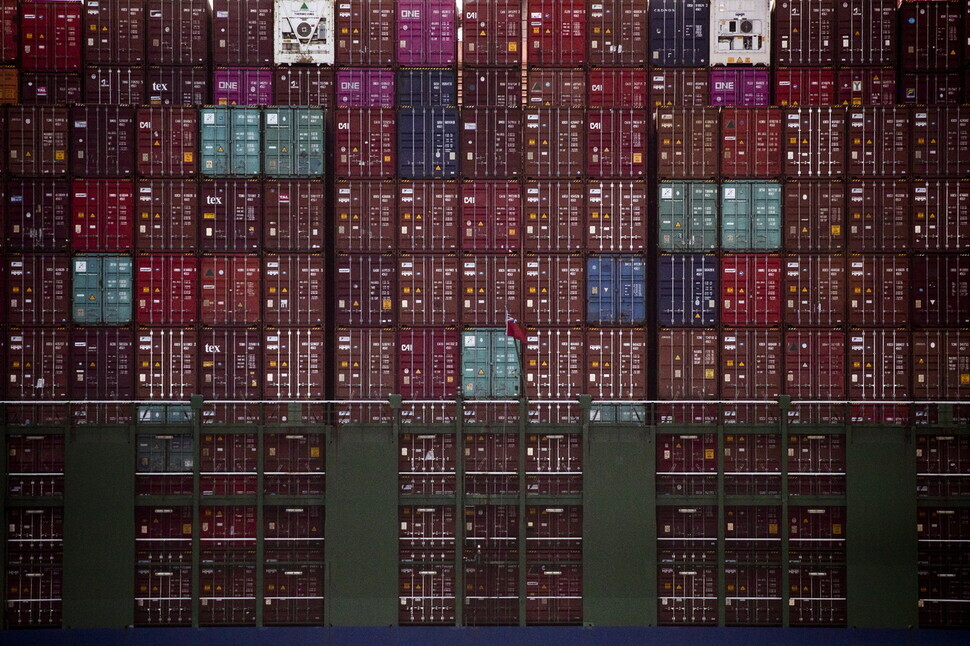

With prices on the rise because of supply bottlenecks as the US enters its shopping season, which runs from Halloween to Christmas, US President Joe Biden announced that the Port of Los Angeles, a major trading junction, will keep running 24 hours a day. Biden also asked representatives from Walmart, FedEx, UPS, Target, the US branch of Samsung Electronics, Home Depot, and the AFL-CIO during a video conference call to help keep the port in constant operation, the Associated Press reported.

Major distribution and logistics firms in the US have also agreed to operate around the clock.

Given a rebound in demand that had been stifled during the pandemic, bottlenecks in the supply chain, and rising energy prices, the US and China — the world’s two biggest economies — are seeing a sharp rise in consumer and producer prices, respectively. That’s leading some economists to say the risk of inflation is increasing.

Consumer prices in China only rose by 0.7% in September, but it’s expected that producers will pass along the increasing cost of raw materials to consumers in China and around the world before long.

In Europe, which represents the world’s third-largest economic region after the US and China, the price of natural gas has quintupled since the beginning of the year because of supply bottlenecks, pushing up the price of goods in all areas. Consumer inflation in September in the 19 countries of the eurozone is tentatively calculated at the rather high level of 3.4%.

Warning lights are also flashing in the Japanese economy, where the price of gasoline has hit a seven-year high.

Amid these developments, the Bank of Korea announced Thursday that the consumer price index for September was 124.58 (relative to 100 in 2015). The index rose 2.4% from the previous month, the biggest jump in seven years and seven months.

The bank said the main factor behind the rising price of imported goods was rising global oil prices. Last month’s exported goods price index ticked up 1.0% from the previous month to 114.18.

By Jung In-hwan, Beijing correspondent and staff reporters Lee Bon-young and Jun Seul-gi

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0502/1817146398095106.jpg) [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

Most viewed articles

- 1Months and months of overdue wages are pushing migrant workers in Korea into debt

- 2[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- 3Bills for Itaewon crush inquiry, special counsel probe into Marine’s death pass National Assembly

- 4[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art

- 560% of young Koreans see no need to have kids after marriage

- 6S. Korea discusses participation in defense development with AUKUS alliance

- 7Trump asks why US would defend Korea, hints at hiking Seoul’s defense cost burden

- 81 in 3 S. Korean security experts support nuclear armament, CSIS finds

- 9Korean firms cut costs, work overtime amid global economic uncertainties

- 10[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis