hankyoreh

Links to other country sites 다른 나라 사이트 링크

Germany looks to selectively decouple with China, cutting reliance in strategic sectors

For Germany, China has represented “the future” for the last 30 years. However, the Russian invasion of Ukraine that began in late February changed everything. The war gave Germany a real feel for the kind of crisis that could result from excessive foreign dependence. Germany, which depended on Russia for 55% of its natural gas imports, has had to endure an unprecedented energy crisis in recent months.

Having experienced this bitter fruit, Germany is now reconsidering its relationship with not only Russia, but also with its largest trading partner, China. This appears due to a sense of crisis that excessive economic dependence on a specific nation could bring disaster, as well as a growing sense that China is not a nation with which we share democratic values.

China has practically connived in Russia’s war, economically benefiting by purchasing large amounts of cheap Russian oil. Chinese President Xi Jinping has established one-man rule by securing his third term in October and is openly expressing his willingness to reunify with Taiwan by force. Beijing is also infringing on the human rights of ethnic minorities in Tibet and Xinjiang and stamping out nascent democratic movements in Hong Kong.

In the agreement that launched Germany’s “traffic-light coalition” last year that brought the Social Democratic Party (red), the Greens (green) and Free Democratic Party (yellow) into one government, China was defined in a multidimensional way — as a "partner, rival and systemic rival." However, while redefining the direction of Germany's new strategy toward China, cracks are emerging.

From chips to ports, Greens oppose sale of critical infrastructure to ChinaIn late October, the traffic light coalition clashed over the issue of Chinese conglomerate COSCO Shipping's investment in Hamburg, Germany's largest trading port. COSCO initially planned to acquire a 35% stake in port operator Hamburger Hafen und Logistik AG (HHLA), but six ministries — including the Foreign Ministry and the Ministry for Economic Affairs and Climate Action led by Vice Chancellor Robert Habeck (Greens) — and coalition partners the Greens and Free Democrats expressed opposition to granting China access to a major piece of German infrastructure.

In the end, Chancellor Olaf Scholz (SDP), the former mayor of Hamburg, permitted COSCO to acquire only a 24.9% stake.

The next controversy was the planned sales of German semiconductor companies Elmos and ERS Electronic to China. On Nov. 9, the German government refused to permit the sales, citing the threat to the national interest if the sales led to the leak of technology.

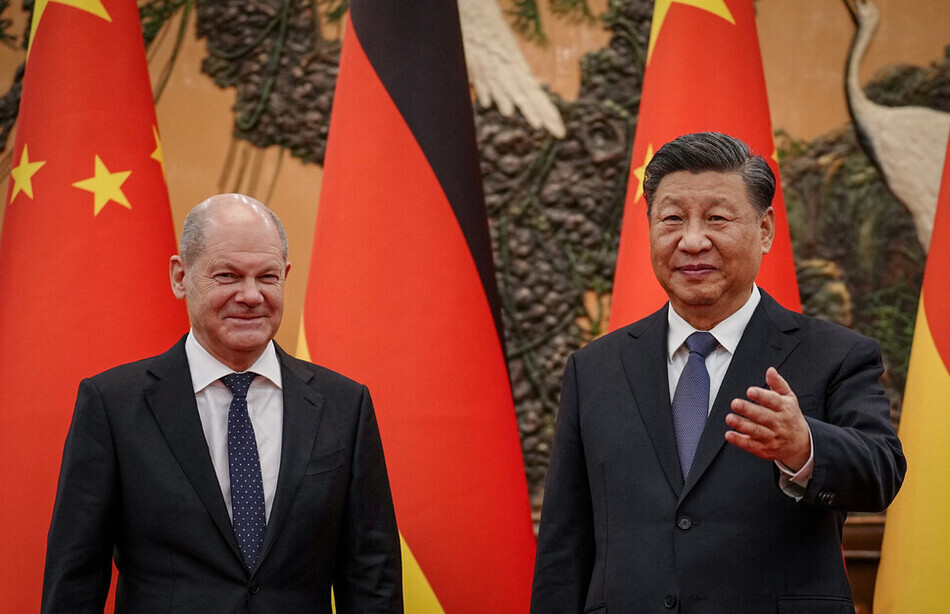

Amid this controversy, Scholz made a surprise visit to China on Nov. 4, unsettling German political circles. In particular, the SDP’s coalition partners, the Greens and Free Democrats, said it wasn't right for the premier of Germany, one of the EU's leading countries, to be the first leader to visit China not even two weeks after Xi was selected for his third term, and with major German businessmen in tow, no less. The issue of China, which arose after the start of the war in Ukraine, has become a major detonator in German politics.

During the visit, Scholz said there would be no “decoupling,” meaning a rupture of ties with China. In fact, according to the Ifo Institute for Economic Research, German companies invested about 10 billion euros in China during the first half of the year alone. In particular, automakers and chemical companies have been especially active investors. Investments by German carmakers Volkswagen, BMW and Mercedes and major chemical company BASF account for one-third of Europe’s total investment in China.

That doesn’t mean that Germany will maintain its current relationship with China. On the contrary.

Scholz said in a speech before the Bundestag on Nov. 23 that he would end the previous government’s energy and trade policies that were overly dependent on Russia and China, warning that if the government left matters as they currently were, “the price would be incomparably high.” Habeck, too, said during talks with G7 finance ministers in September that the time for naivety in relations with China had ended.

The German government is currently drawing a new strategy toward China. The core of the strategy is reducing dependence on China.

China has been Germany's largest trading partner for six straight years, since 2016. According to Germany's federal statistics agency, Germany and China conducted 246.5 billion euros in trade in 2021, making China Germany's largest trading partner in trade volume. German imports from China amounted to about 143 billion euros that year, more than from any other trading partner, while exports to China totaled about 104 billion euros, second only to the United States (120 billion euros).

China, too, is expanding its relationship with Germany, buying up many leading German companies. According to the Hans Böckler Foundation, 193 Chinese companies purchased full or partial shares in 243 German companies between 2011 and 2020.

A roughly 100-page paper outlining strategy for China, the general content of which was recently revealed by Germany's domestic media, appears to focus on decreasing and readjusting Germany's relationship with China. This is because Germany's dependence on China narrows Berlin's political space and leaves Germany “vulnerable to threats.” According to The Pioneer, Reuters and other media, the document especially includes concerns that China could invade Taiwan in 2027. According to the Süddeutsche Zeitung newspaper, the German government turns down all questions asking for confirmation.

More specifically, the German government is considering measures such as reducing incentives to lessen export inducements in the automotive and chemical sectors, strengthening reporting obligations for German corporations operating in China, mandating stress testing for companies exposed to China, and limiting government investment guarantees to 3 billion euros per company. Habeck has long expressed a strong desire to limit exposure to Chinese capital in major sectors such as communications, energy, semiconductors, ports and medicine.

By Noh Ji-won, Berlin correspondent

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0507/7217150679227807.jpg) [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

Most viewed articles

- 1Behind-the-times gender change regulations leave trans Koreans in the lurch

- 2Family that exposed military cover-up of loved one’s death reflect on Marine’s death

- 3Yoon’s revival of civil affairs senior secretary criticized as shield against judicial scrutiny

- 4Japan says its directives were aimed at increasing Line’s security, not pushing Naver buyout

- 5Unexpected rate of AI development requires timely discussion of side effects

- 6[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- 7Marines who survived flood that killed colleague urge president to OK special counsel probe

- 8[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 9S. Korean first lady likely to face questioning by prosecutors over Dior handbag scandal

- 10Is Japan about to snatch control of Line messenger from Korea’s Naver?