hankyoreh

Links to other country sites 다른 나라 사이트 링크

China’s deflationary spiral could be worse than Japan’s “lost decades”

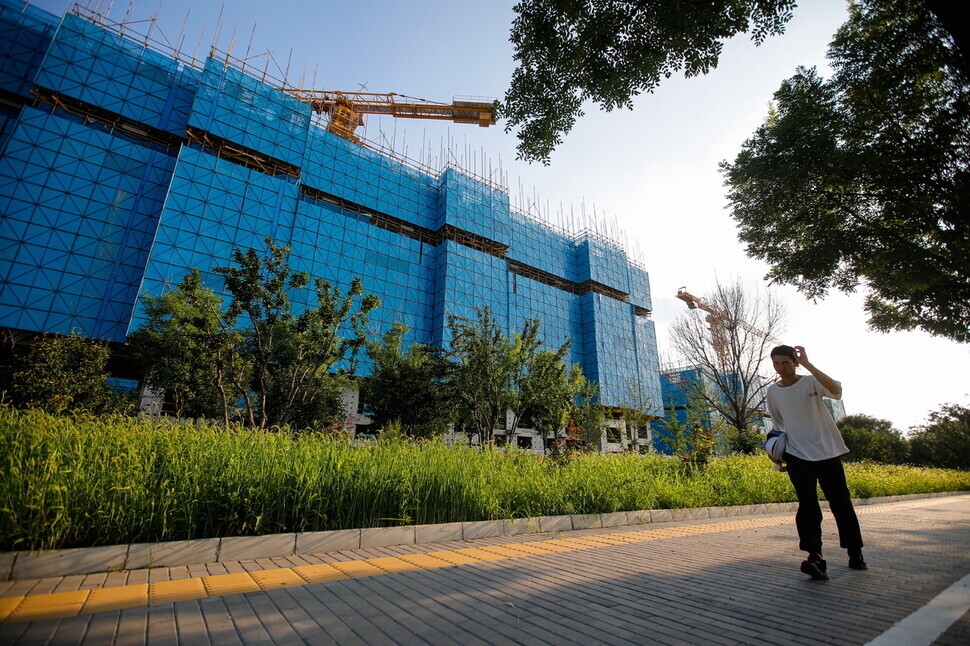

With Country Garden and other major Chinese real estate developers missing interest payments on outstanding loans, there are growing concerns that the real estate crisis will shake the entire Chinese economy. Some in the US and Japan are afraid that a Chinese economic crisis could be even worse than Japan’s “lost decades” starting in the 1990s.

The repeated failure of Chinese real estate developers to keep up with their interest payments can be seen as the market realization of China’s economic crisis. Despite expectations that the Chinese economy would rebound swiftly after COVID-19 lockdowns were lifted last December, signs of a robust recovery have been conspicuously absent.

That appears to be mainly due to sluggish exports. Since May, Chinese exports have fallen for three consecutive months. In August, they were down 14.5% from the same period last year.

Another factor that’s darkening China’s economic prospects is a troubling trend in the price of goods. China’s consumer price index in July fell 0.3% from the same period last year. That was the first drop in consumer prices in two years and five months, since February 2021 — in the middle of the pandemic.

Producer prices have been falling as well. The figure moved into negative territory (-0.8%) in January and dropped to -5.4% by June.

The perception that prices are falling motivates people to put off spending, pushing the economy into a deflationary spiral.

The strategy of “dual circulation” that the Chinese Communist Party unveiled in May 2020 was ultimately designed to stimulate the domestic economy and power through the economic crisis.

But following the pandemic, we haven’t seen the expected recovery in China’s domestic economy. Instead, Chinese households set aside 12 trillion yuan (around US$1.7 billion) in the first half of the year in the largest savings increase in a decade.

Western newspapers including the New York Times, Wall Street Journal and Financial Times have observed that Chinese consumer incomes were reduced and consumer sentiment was depressed by COVID-19 lockdowns that lasted for over two years.

Aside from falling incomes, a major factor that has dampened consumer sentiment is the real estate crisis, which came to light when the Evergrande Group ran into trouble in the fall of 2021. Real estate is the biggest asset for most Chinese families, and depreciating assets tend to crimp spending.

The two pillars of economic growth in China since its reform and opening in the 1980s have been exports and large state-led development projects. Huge construction projects backed by state-funded banks and state-secured loans have created large numbers of jobs.

The property built in this way has risen steadily in value along with economic growth, while also serving to encourage spending. That in turn became a driver of growth in the Chinese economy.

At the same time, regional governments that encouraged unrealistic construction projects ended up saddled with large amounts of debt. And when China’s red-hot growth began to cool down, the real estate boom ran into fundamental limitations.

Adam Simon Posen, a renowned economist and strategist from the US who is president of the Peterson Institute for International Economics, recently wrote in an article for Foreign Affairs that the Chinese economic miracle is over, and that the outcome of the US-China rivalry has been decided.

Nobel laureate Paul Krugman, a professor at the City University of New York who correctly predicted the Asian financial crisis of 1997-1998, offered a pessimistic outlook on China.

“Some have been asking whether China’s future path might resemble that of Japan. My answer is that it probably won’t — that China will do worse.”

The Japanese press also gave a troublesome analysis of trends in the Chinese real estate market. “China could enter a period that’s even darker than Japan’s ‘lost 30 years,’” Gendai Business wrote.

Considering that China has represented 40% of the world’s economic growth, a recession in China is synonymous with a global economic crisis. And such a crisis would assuredly have serious consequences for the Korean economy, where growth has long depended on exports to China.

By Jung E-gil, senior staff writer

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0507/7217150679227807.jpg) [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

Most viewed articles

- 1Yoon’s broken-compass diplomacy is steering Korea into serving US, Japanese interests

- 2[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- 3[Column] Why Korea’s hard right is fated to lose

- 4S. Korean first lady likely to face questioning by prosecutors over Dior handbag scandal

- 5Lee Jung-jae of “Squid Game” named on A100 list of most influential Asian Pacific leaders

- 6After 2 years in office, Yoon’s promises of fairness, common sense ring hollow

- 7[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 8[Column] The state is back — but is it in business?

- 960% of young Koreans see no need to have kids after marriage

- 10[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press