hankyoreh

Links to other country sites 다른 나라 사이트 링크

Samsung launches largest semiconductor production line with a murmur

Despite finishing construction on the world‘s largest semiconductor production line at the cost of 15 trillion won (US$13.04 billion), Samsung Electronics started operations without holding a lavish celebration. The company announced that it would be investing more than 37 trillion won in the booming sectors of semiconductors and displays (including the 15.6 billion won it spent on the first production line in Pyeongtaek, Gyeonggi Province). But some securities analysts argue the investment doesn’t meet expectations.

At a launch event held at Samsung’s semiconductor complex in Pyeongtaek on July 4, the company announced it had begun production on 3D V-NAND flash memory. Construction of the Samsung semiconductor complex in the Godeok Industrial Complex in Pyeongtaek started in May 2015, and the site has an area of 2.89 million square meters, around the size of 400 soccer fields. The company said that the P1 production line, where the event was held, is the world’s largest single production line. NAND flash is a semiconductor that continues to save data in memory even when there is no power.

The launch event was modest, with just over 100 staff in attendance, including Samsung Electronics Vice Chairman Kwon Oh-hyun and Kim Ki-nam, the president of the company’s semiconductor operations. During the facility’s ground-breaking two years ago, there was a massive event under the slogan “planting the future” that was attended by more than 600 people, including former president Park Geun-hye and Gyeonggi Province Governor Nam Kyung-pil. While the company is expected to post its best performance ever in the second quarter of this year thanks to the boom in semiconductors, it concluded that this wasn’t the time for a lavish party, with Vice Chairman Lee Jae-yong in jail during his trial.

Samsung Electronics has also released its investment plans. It will be immediately expanding the first production line in Pyeongtaek, making a further investment of 14.4 trillion won through 2021. It’s also planning to invest 6 trillion won more at its facility in Hwaseong, Gyeonggi Province, to build a new production line. Furthermore, the company is considering the option of additional construction at its semiconductor production line in Xi’an, China, in order to achieve economies of scale.

“In light of the [bull] market, we’re planning to proactively invest in expanding our production ability and to respond proactively to our global customers‘ increasing demand for semiconductors,” Samsung Electronics said. This is the first large-scale investment plan that the company has announced since Lee Jae-yong was jailed in February. The company predicted that this investment will result in 163 trillion won of production and create 440,000 jobs by 2021. Samsung Display also announced that it’s looking into investing around 1 trillion won through 2018 to build a new facility for organic light-emitting diodes (OLED) at Tangjeong, Asan, South Chungcheong Province.

Semiconductors have been in a bull market recently. “Chinese smartphone makers are making every effort to expand their memory capacity, and they’re bringing piles of cash to South Korea to secure the key components of DRAM and NAND flash,” reported Chinese newspaper the Global Times. In addition to smartphones, increasing construction of data centers and the expansion of artificial intelligence and automotive electronics are driving up demand for cutting-edge semiconductors. Market research organization IHS predicted that the NAND flash market would grow to 508.4 billion gigabytes by 2020, nearly five times its 2016 level of 119.8 billion gigabytes.

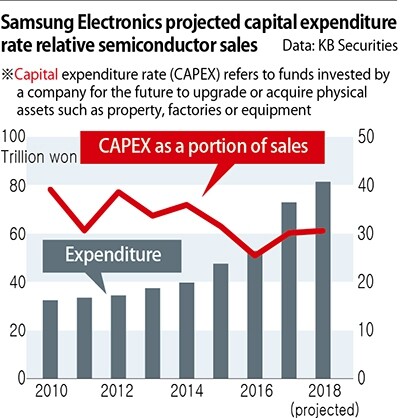

But some analysts think that Samsung Electronics’ investment plan is not aggressive. A report by KB Securities noted that Samsung Electronics maintained a capital expenditure (CAPEX) rate of 35% as a portion of semiconductor sales from 2010 to 2014 while predicting a CAPEX rate of around 30% this year and next year. The securities firm predicted that investment in expanding production facilities would not increase very much, in contrast with the past.

“We were already expecting the additional construction at the Pyeongtaek plant, and Samsung didn‘t reveal the amount of its other investments. Samsung appears to have had the trial [of Vice Chairman Lee Jae-yong] in mind when it released this information, apparently hoping to remind people that Samsung is an important company for domestic investment,” said an analyst with one security firm.

“The announcement of this investment doesn’t mean the end of Samsung‘s parsimonious investment. Once they move ahead with this year’s factory construction, there will be a steep fall in investment,” predicted an analyst at another security firm.

On July 4, Samsung Electronics‘ stock was down 11,000 won (0.47%) from the previous day of trading despite the news about the launch event on the Pyeongtaek production line. Stock prices also declined for the main companies that supply semiconductor equipment to Samsung Electronics despite its plan to invest trillions of won.

By Lee Wan, staff reporter

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?![[Column] Life on our Trisolaris [Column] Life on our Trisolaris](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0505/4817148682278544.jpg) [Column] Life on our Trisolaris

[Column] Life on our Trisolaris- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

Most viewed articles

- 160% of young Koreans see no need to have kids after marriage

- 2[Column] Life on our Trisolaris

- 3Amid US-China clash, Korea must remember its failures in the 19th century, advises scholar

- 4New sex-ed guidelines forbid teaching about homosexuality

- 5[Column] The state is back — but is it in business?

- 6How daycares became the most viable business for the self-employed

- 7Presidential office warns of veto in response to opposition passing special counsel probe act

- 8OECD upgrades Korea’s growth forecast from 2.2% to 2.6%

- 9Hybe-Ador dispute shines light on pervasive issues behind K-pop’s tidy facade

- 10[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art