hankyoreh

Links to other country sites 다른 나라 사이트 링크

The potential future of S. Korea’s semiconductor ecosystem

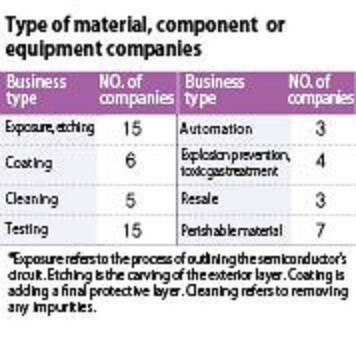

With the current vulnerabilities in the semiconductor ecosystem taking shape amid the South Korean semiconductor industry’s dominance of the global market over more than two decades, is change impossible? It’s too soon to give up hope. Already some of the companies are working hard to develop their own technical capabilities and turn their attention to overseas customers. Experts who examined the semiconductor ecosystem closely also concluded that “potential outlets do exist.”

The semiconductor equipment company Eugene Technology was named as a model example. The company has 268 overseas patent applications alone -- nearly double the 136 applications it has in South Korea. The numbers are evidence that its focus in investment and technology development has long been on overseas markets rather than the domestic one. While Samsung Electronics and SK Hynix were its chief clients as recently as 2008, the company began also supplying to overseas semiconductor companies last year.

“We determined that if we depended on the domestic market exclusively, we might survive easily, but we would never make it beyond that level,” explained one of the company’s senior executives in a Jan. 14 telephone interview with the Hankyoreh.

“Just as there have been many world-class material, component, and equipment companies even after the US lost its dominance of memory semiconductors [to Japan and South Korea], now it’s time for South Korea’s material, component, and equipment companies to turn their attention to the rest of the world,” the official said.

For domestic suppliers of semiconductor materials, components, and equipment, the growing number of cases of semiconductor manufacturers commissioning the development of high-tech products from such companies amid Japan’s export controls has been an opportunity. One example of this is SoulBrain, which recently succeeded in mass production of the highly pure hydrogen fluoride that had previously been made by Japanese material companies. The company had possessed the technology for the product for years, but had not increased its production facilities due to the uncertain market. As the Japanese export controls paved the way for supplies to Samsung Electronics and SK Hynix, the company built a new factory last year. UB Materials, which succeeded in domestic production of the tungsten slurry previously monopolized by Cabot, was selected last year as an SK Hynix “innovation businesses,” allowing it to both secure technology development funding and establish its reputation.

Government support should be provided more efficiently

“The technology at South Korea’s semiconductor material, component, and equipment companies is focused on all-purpose products, and core technology capabilities are lower than those of US or Japanese competitors,” explained Kim Yang-paeng, a researcher at the Korea Institute for Industrial Economics and Trade.

“If it’s too much to try to outcompete global rivals in terms of high-tech processes, it may be worth considering making early inroads into next-generation technology,” Kim suggested.

“Since next-generation areas involve a substantial amount of time for research and development, South Korea’s semiconductor manufacturers may be able to generate positive results by collaborating with material, component, and equipment companies in this area,” he added, suggesting that South Korea’s mid-size companies might put their heads together in the area of next-generation semiconductors in the same way that Samsung Electronics built up its semiconductor ultra-fine process market in collaboration with the Dutch company ASML and Japanese company Shin-Etsu in 2012.

Some industry observers argued that government support should be provided in a more efficient manner. Speaking on condition of anonymity, a senior executive at one mid-size semiconductor company said, “The government claims to be supporting 100 material, component, and equipment companies, but only a small few have produced real results.”

“These days, people in the semiconductor industry talk about how ‘anyone who isn’t getting money from the government is an idiot.’ If you break things down in terms of fairness, it’s really a gray area,” the executive added.

Shin Da-eun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles![[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/9417144634983596.jpg) [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

Most viewed articles

- 1Months and months of overdue wages are pushing migrant workers in Korea into debt

- 2Trump asks why US would defend Korea, hints at hiking Seoul’s defense cost burden

- 3[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 4[Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- 51 in 3 S. Korean security experts support nuclear armament, CSIS finds

- 6At heart of West’s handwringing over Chinese ‘overcapacity,’ a battle to lead key future industries

- 7Fruitless Yoon-Lee summit inflames partisan tensions in Korea

- 8[Column] Can Yoon steer diplomacy with Russia, China back on track?

- 9South Korea officially an aged society just 17 years after becoming aging society

- 10Under conservative chief, Korea’s TRC brands teenage wartime massacre victims as traitors