hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] Apartment owners increasingly giving away property to family members instead of selling it

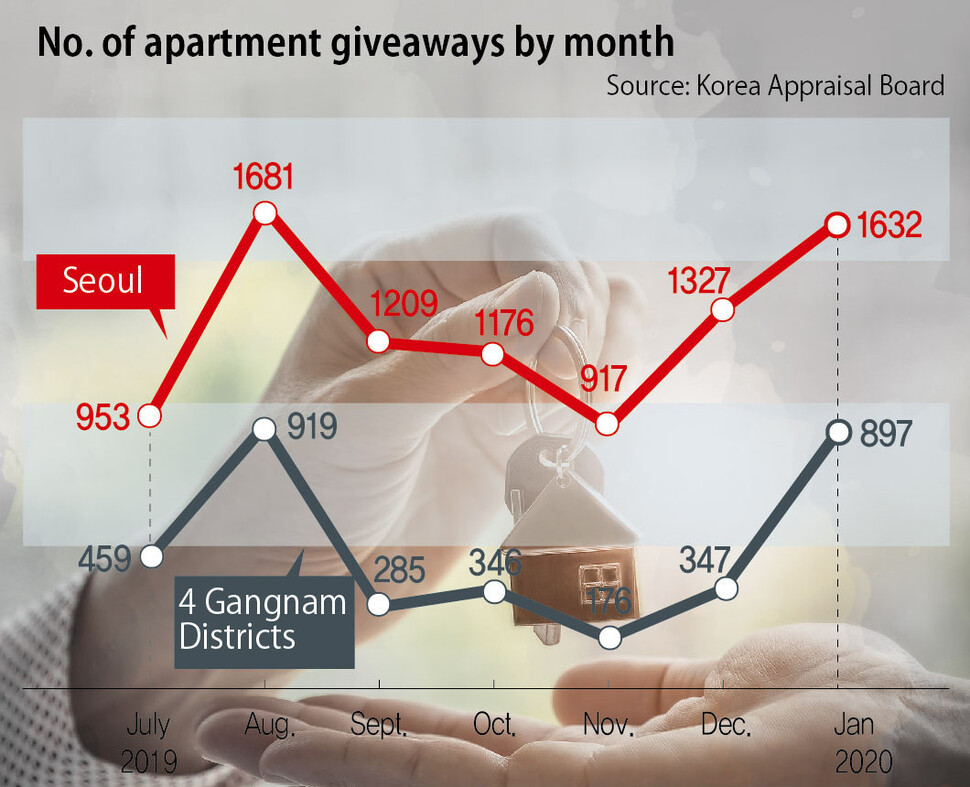

A rapid increase in “gifts” of apartments in Seoul’s four Gangnam districts (Gangnam, Seocho, Songpa, and Gangdong) among family members this year is attracting attention. According to an examination of Korea Appraisal Board real estate transaction figures on Mar. 11, a total of 1,632 instances of apartments being given away was recorded in Seoul for January, the highest number since the 1,681 instances registered five months earlier in August 2019. In particular, 897 of the giveaways -- or 55% of the total for Seoul -- were in the four Gangnam districts, which are home to a high concentration of expensive apartments. After previously reaching an annual high of 919 instances in August of last year, the number of apartment giveaways in the four Gangnam District had been declining steadily before the rebound to 897 instances in January 2020.

Real estate industry observers saw the recent phenomenon of increasing apartment giveaways in the four Gangnam districts and elsewhere in Seoul as signaling that as multiple home owners face a growing burden with the comprehensive real estate tax and other property taxes, they are opting for giveaways rather than sales as a way of reducing the number of homes they own. While the total number of apartment sale transactions in Seoul was down to 10,491 for January from 14,117 in December, the number of apartments given away rose from 1,327 to 1,632.

In a real estate market stabilization plan announced on Dec. 16 of last year, the South Korean government decided to apply a special long-term ownership deduction and waive extra transfer tax charges (up to 62%) for multiple home owners who sold houses owned for 10 years or more in Seoul and other regions subject to adjustment by the end of June 2020. This opened up a limited-time “escape route” for multiple owners, with the Ministry of Land, Infrastructure and Transport (MOLIT) estimating the number of residences in Seoul meeting the criteria of 10 or more years of ownership by a multiple home owner at 128,000. The government’s expectation was that the emergence of these multiple home owner residences on the market would help to stabilize housing prices.

But some have argued that the government’s approach of offering a limited-time exemption from extra taxation is unlikely to produce the anticipated effects. Critics have also contended that the restriction in tax benefits to residences owned for 10 or more years was too narrow, and that with the tight window of six months for sales, the end result was a “condescending” policy approach.

Analysts further suggested that multiple home owners were more likely to decide from the outset that giving their homes away to family members was a better approach than putting them on the market. A comparison between selling off an expensive home owned for 10 or more years in Seoul and giving it away to family shows that for multiple home owners, the giveaway method translates into a slightly higher immediate tax burden but potentially larger anticipated future gains.

Take the examples of a multiple home owner disposing of a Gangnam apartment with a market value of 1.5 billion won (US$1.24 million; acquisition price of 700 million won, or US$577,689) that has been owned for 10 years or more. That homeowner can either sell the apartment off before the end of June 2020 or give it away as a gift to their child. If they sell the apartment, the special long-term ownership deduction (20% for 10 years) is applied to the 800 million won (US$660,170) transfer difference, while the tax rate (42%) is increased, leaving them with a transfer tax bill totaling 233.4 million won (US$192,605). If they give the apartment to their child, they would receive a direct descendant deduction of 50 million won (US$41,260) with a relatively high tax rate of 40%, leaving them with 420 million won (US$346,589) in gift taxes to pay. They would also have to pay a separate acquisition tax of 49.5 million won (US$40,848; 3.3% tax rate over 900 million won, or US$746,691) at the time of the giveaway.

The “invincibility” aura of Gangnam real estateWhile a simple comparison of tax burdens shows that the gift tax for giving away a residence to a child is larger than the transfer tax would be, experts argue that multiple home owners are very likely to favor the giveaway approach in practice. First, there is the potential for tax avoidance -- saving a bit more on taxes by making a “conditional donation” that passes along liabilities such as key money deposits when houses are given away to children who have established generation separation. There’s also the lingering aura of “invincibility” surrounding Seoul’s Gangnam area, where apartment prices are seen as unlikely to ever fall. Another factor in the preference for giveaways over sales among multiple home owners in the recent real estate market and its widespread “one super house” phenomena, where people are seeking to own one residence in a popular region.

“The reality is the number of eligible homes is too small and the extra taxation exemption period is too short to get multiple home owners to actively sell off their residences,” said Ahn Su-nam, CEO of the Dasol Tax Service.

“At the moment, there is a very strong chance that multiple home owners will give away homes to their generation-separated children to avoid the big increase in the comprehensive real estate tax burden at the end of this year,” Ahn predicted.

Structural issues with the comprehensive real estate tax have also been pointed to as another factor pushing multiple home owners toward giveaways. Since the tax operates under an approach of taxation by individual, a high tax rate for multiple home owners can be avoided by distributing housing ownership among family members.

By Choi Jong-hoon, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 2AI is catching up with humans at a ‘shocking’ rate

- 3South Korea officially an aged society just 17 years after becoming aging society

- 4Noting shared ‘values,’ Korea hints at passport-free travel with Japan

- 51 in 5 unwed Korean women want child-free life, study shows

- 6Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 7Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 8Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 9[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 10Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government