hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] Prospects for semiconductor industry appear dark for 3rd, 4th quarters

As the second wave of COVID-19 picks up speed both in South Korea and around the world, more and more activities are being conducted remotely, with more employees working from home. Nevertheless, the prevailing view is that the semiconductor industry won’t see a repeat of the boom it enjoyed in the first half of the year as companies ramped up acquisition of servers because of the pandemic. If anything, the industry faces gloomy prospects for the second half of the year.

DRAM shipments and prices projected to stallAccording to a report released on Aug. 18 by Taiwan-based market research firm TrendForce, shipments and prices of DRAM semiconductors will remain static as shipments of servers in the third quarter decline 4.9% from the second quarter. In fact, the prices of DRAM and NAND flash semiconductors have been slipping downward in recent months, contrasting with the 17.8% jump in contract prices that DRAM saw in the first half of 2020. TrendForce reported that the contract prices of 32GB DRAM for servers hit US$134 in July, down 6.39% from June (US$143). Spot prices in the semiconductor market, which serve as an early indicator of contract prices, have also continued to decline, making it likely that the downturn will continue in the third and fourth quarters of the year.

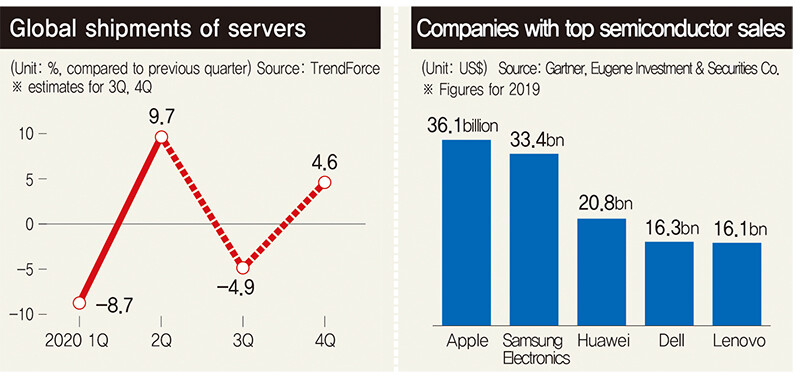

One reason for this marked decline in semiconductor prices is a drop-off in demand for server semiconductors at global IT firms, which had driven increasing demand for semiconductors in the first half of the year. In the second quarter alone, when semiconductor firms were in the middle of the COVID-19 boom, global server shipments rose 9.7% from the previous quarter. With the pandemic driving a shift from face-to-face to remote activities, companies with a strong presence in the cloud such as Google, Amazon, and Facebook aggressively expanded their data centers. On top of that, companies stocked up more semiconductors than they actually needed to prepare for potential interruptions to the supply chain that COVID-19 might cause.

All this means that Samsung Electronics and SK Hynix’s third quarter earnings are likely to fall far short of the stunning performance they showed in the second quarter, at the height of the COVID-19 pandemic. Samsung Electronics’ semiconductor division posted sales of 18.23 trillion won (US$15.3 billion; 14.61 trillion won [US$12.28 billion] in memory semiconductors) and operating profits of 5.43 trillion won (US$4.56 billion) in the second quarter, its best showing since the fourth quarter of 2018. Operating profits in the sector were up 2.3 trillion won (US$1.9 billion) from the second quarter of last year, greatly exceeding market projections. SK Hynix was another beneficiary of the COVID-19 boom in the second quarter, posting sales of 8.61 trillion won (US$7.23 billion) and operating profits of 1.95 trillion won (US$1.64 billion). In particular, its operating profits represented a year-on-year increase of 205.3%.

Shock to global value chain another negative factor

Another reason for the semiconductor industry’s darkening prospects in the second half of the year is the growing uncertainty in the market produced by the US’ tightening of sanctions against Chinese company Huawei, which is not only a major purchaser of semiconductors but has also played a key role in the global value chain. On Aug. 17, the US Commerce Department rocked the global semiconductor value chain and distribution network when it prohibited semiconductors using US technology from being supplied to Huawei. According to market research firm Gartner, Huawei purchased US$20.8 billion worth of semiconductors in 2019, ranking third globally behind Apple (US$36.1 billion) and Samsung Electronics (US$33.4 billion). Huawei accounts for 3.2% and 11.4% of sales to Samsung Electronics and SK Hynix, respectively.

Another factor that should not be omitted is the severe contraction in the retail market because of the recent second wave of COVID-19, undermining expectations about typical seasonal shopping sprees around Thanksgiving and Christmas. Originally, there had been hopes that consumption would recover from the coronavirus slump in what’s dubbed “revenge spending” and that the launch of the Galaxy Note 20 and the new model of the iPhone would expand the mobile market in the second half of the year. But those hopes have been dashed by recent indications that COVID-19 is once again on the rise.

Market observers are cautiously predicting that the semiconductor market won’t recover until the first or second quarter of next year at the earliest. “There was so much investment in the server sector in the first half of the year that we’re seeing a reaction in the second half of the year, with data centers leading a decline in demand. The sector is expected to recover in the first half of 2021,” said Do Hyun-woo, an analyst at NH Securities.

By Koo Bon-kwon, senior staff writer

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 3Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 4After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 5BTS says it wants to continue to “speak out against anti-Asian hate”

- 6AI is catching up with humans at a ‘shocking’ rate

- 7Noting shared ‘values,’ Korea hints at passport-free travel with Japan

- 8Gangnam murderer says he killed “because women have always ignored me”

- 9South Korea officially an aged society just 17 years after becoming aging society

- 10Ethnic Koreans in Japan's Utoro village wait for Seoul's help