hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korean companies see record decline in sales for Q2 2020

South Korean companies saw a record-setting double-digit decline in revenue in the second quarter (Q2) of 2020 amid the shock of the COVID-19 pandemic. Companies’ operating profit margin and other measures of profitability also took a tumble.

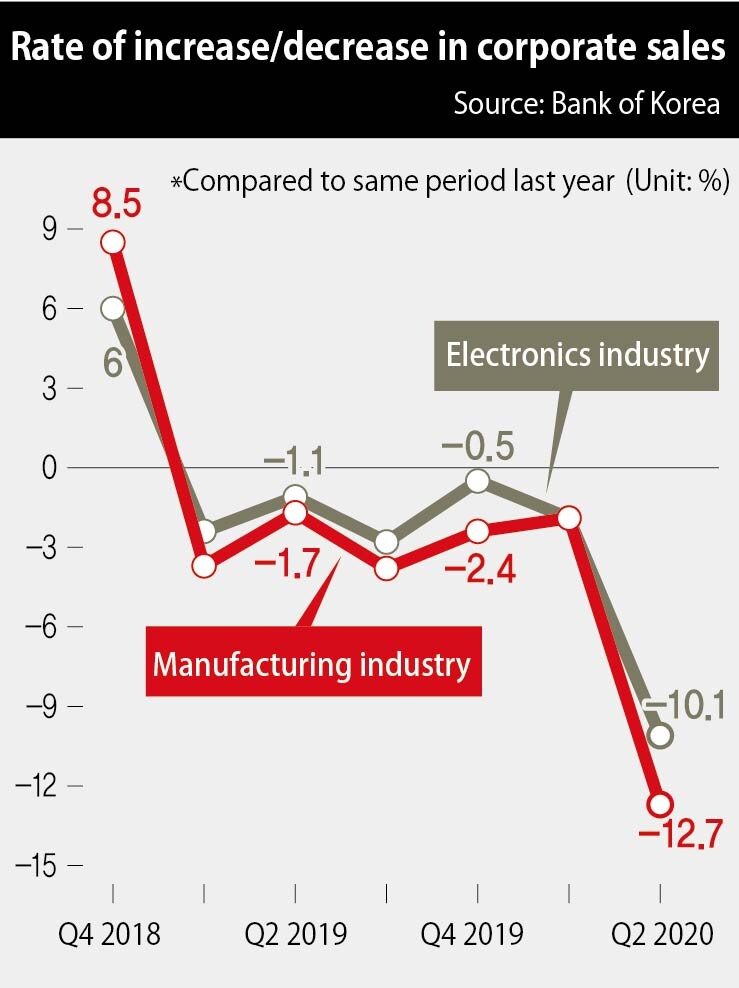

In an analysis of Q2 performance of 3,862 companies with external audits released on Sept. 15, the Bank of Korea (BOK) found that sales declined by 10.1% from the previous year, the biggest decrease since the bank began tracking figures in 2015. The rate of decline was more than five times greater than in Q1 (-1.9%), when the COVID-19 crisis began. South Korea’s export-oriented manufacturers appear to have taken a big hit when the US and Europe announced strict lockdowns in Q2. Corporate sales have been falling for six consecutive quarters, since the Q1 2019. Growth drivers are sputtering, causing companies to shrink in size.

The sector that saw the biggest drop in sales was manufacturing, at 12.7%. Plunging international oil prices slashed revenues at petrochemical companies by 26.8%, while sluggish demand for automobiles cut revenues in the transportation equipment sector by 17.3%. Revenue in the service sector and other non-manufacturing sectors fell by 6.5%, in the biggest decline on record. With fewer passengers and less cargo on the move, revenue in the transportation industry dropped sharply, by 15.8%. The contraction in trade also delivered a blow to the wholesale and retail sectors, where sales dropped by 6.9%.

Total assets (capital plus debts), another indicator of corporate size, grew by 1.1% over the previous year because of rising debt. South Korea’s chaebol issued more corporate bonds in order to raise emergency funds to counter uncertainty resulting from COVID-19.

Companies’ profitability fell as well. Operating margin (the ratio of operating income to net sales) fell from 5.5% in Q2 2019 to 5.3%. The manufacturing sector saw the biggest downturn, from 5.7% to 5.3%. The operating margin in the transportation equipment industry dropped to 1.0%. The metal products sector saw its operating margin fall from 6.5% to 3.6% as the profit structure deteriorated: the prices of imported raw materials (such as iron ore) rose while the prices of products fell.

Operating margin in non-manufacturing sectors only fell 0.1 points to 5.3%, boosted by a higher margin in the transportation sector (4.2% to 6.4%), where higher fares on cargo offset a decline in volume in international aviation. Small and medium-sized enterprises (SMEs) faced a bigger decline in operating margin (0.7 points) than chaebols (0.1 points).

“The drop in company revenues was unusually high compared to the nominal growth rate in the second quarter [-1.6% year on year]. We’ve entered a period of economic contraction in which sales and operating profits decrease simultaneously except for a few blue chip companies,” said Kim Young-ik, adjunct professor at Sogang University’s graduate school of economics.

The pre-tax net profit margin was also measured at 5.2%, down 0.2 points. That means that companies only make 52 won (US$.044) in profit for every 1,000 won (US$.85) of products they sell. The net profit margin for SMEs plunged 1.1 points to 5.1%, dropping below the chaebol level (5.2%).

The debt ratio, which measures corporate stability, stood at 87%, down from 88.2% in the first quarter. That reflected the dividends companies distributed in the second quarter, dividends which had been calculated as liabilities in the first quarter. At the same time, the ratio of total borrowings to total assets rose 0.3 points to 25.6% as companies issued more bonds.

By Han Gwang-deok, finance correspondent

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 3Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 4Noting shared ‘values,’ Korea hints at passport-free travel with Japan

- 5AI is catching up with humans at a ‘shocking’ rate

- 6Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 7Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 8[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 9A week of protests lays bare many inherent vices of Korean health care system

- 10Yoon says collective action by doctors ‘shakes foundations of liberty and rule of law’