hankyoreh

Links to other country sites 다른 나라 사이트 링크

Intel dives into foundry market

The US company Intel, which has been facing threats to its dominance as an integrated device manufacturer (IDM), has announced plans for a full-fledged foray into the foundry market.

Amid an intensifying global semiconductor supply shortage, the company’s strategy involves turning commissioned fabrication into a new growth driver, as it not only produces its own semiconductor designs but also recruits outside clients such as Amazon, Google and Qualcomm.

Many are watching to see what effect this has on the current top two companies in the global foundry market, Taiwan’s TSMC and Samsung Electronics.

US$20 billion investment to build two new factories in ArizonaAt a Wednesday online event titled “Intel Unleashed: Engineering the Future,” Intel announced its “IDM 2.0” vision, which included plans for the investment of around US$20 billion to build two foundry plants in Arizona.

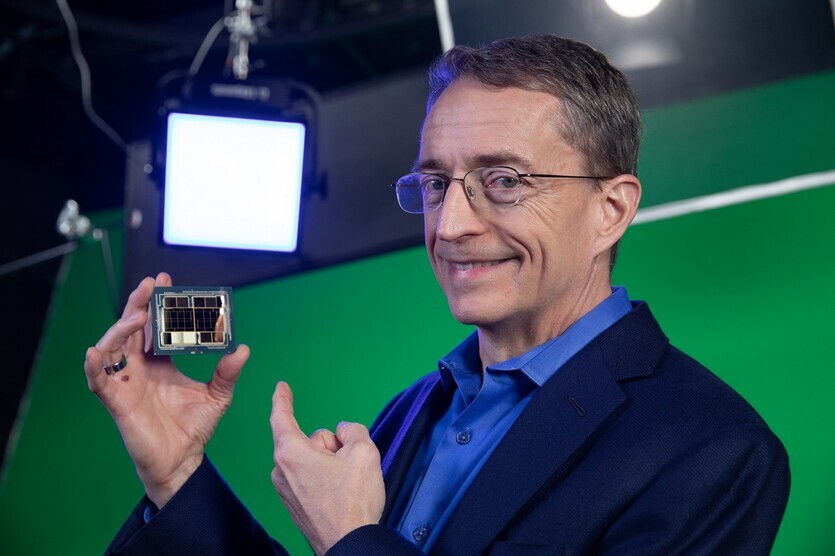

During the event, Intel CEO Pat Gelsinger noted that the foundry market was predicted to grow to a scale of US$100 billion by 2025. He went to say that Intel would become an important provider of foundry capacity in the US and Europe.

Intel’s announcement is being seen as signaling its commitment to overcoming the current threat to its stature as an IDM that in the past was responsible for the entire process from semiconductor design to production.

Not only have emerging central processing unit (CPU) forces AMD and Nvidia been gnawing away at Intel’s market share recently, but Apple — previously an important client of Intel’s — announced last year that it was parting ways to develop its own chips.

In the area of chip production, Intel found itself in the situation of having to commission production of its own semiconductor designs due to process setbacks over the past few years for the 14-nanometer (nm) to 10nm range and under.

The event was the first strategy declaration by Gelsinger since he took over in February as Intel CEO, replacing Bob Swan, who stepped down as a gesture of responsibility for the issues. In an apparent nod to the crisis, Gelsinger announced plans for the 7nm process involving “increased use of extreme ultraviolet lithography in a rearchitected, simplified process flow.”

As of 2023, Intel plans to internally produce CPUs for its 7nm process.

”Samsung and TSMC will remain unchallenged”Experts were generally guarded in their assessments. They viewed the move as a positive step in improving production capabilities but saw Intel as unlikely to make a meaningful dent in the existing foundry market structure.

As a late starter, the company will be hard pressed to catch up in a short time with the technology of Samsung Electronics and TSMC, which have already established 5nm processes and begun development on 3nm technology.

“Beyond smartphone semiconductors, the chips used in things like virtual reality (VR) and augmented reality (AR) can also be produced with 14nm and 7nm processes, so it appears that they’re entering the foundry market in terms of market diversity,” said Park Jea-gun, a Hanyang University professor who chairs the Korean Society of Semiconductor and Display Technology.

But Park added, “Intel’s technological capabilities are still weak, and Samsung Electronics and TSMC will remain unchallenged when it comes to 5nm processes and under.”

Analysts also said Intel’s new foundry plants would not be large enough in scale to attract large numbers of outside clients.

“The Intel foundries aren’t going to be a format where they’re relying 100 percent on outsourcing like TSMC. Instead, it’s going to be a system when they produce their own products and then use their leftover capabilities to meet outside demand,” explained Kim Yang-paeng, a researcher at the Korea Institute for Industrial Economics and Trade.

“An investment of US$20 billion won’t give them a lot of outside fabrication volume, so they don’t appear likely to challenge TSMC or Samsung Electronics,” Kim predicted.

By Song Chae Kyung-hwa, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0502/1817146398095106.jpg) [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

Most viewed articles

- 160% of young Koreans see no need to have kids after marriage

- 2Presidential office warns of veto in response to opposition passing special counsel probe act

- 3Months and months of overdue wages are pushing migrant workers in Korea into debt

- 4[Reporter’s notebook] In Min’s world, she’s the artist — and NewJeans is her art

- 5[Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- 6Japan says it’s not pressuring Naver to sell Line, but Korean insiders say otherwise

- 7OECD upgrades Korea’s growth forecast from 2.2% to 2.6%

- 8Hybe-Ador dispute shines light on pervasive issues behind K-pop’s tidy facade

- 9Inside the law for a special counsel probe over a Korean Marine’s death

- 10At heart of West’s handwringing over Chinese ‘overcapacity,’ a battle to lead key future industries