hankyoreh

Links to other country sites 다른 나라 사이트 링크

US unlikely to pursue intensive sanctions against China’s semiconductor sector, experts say

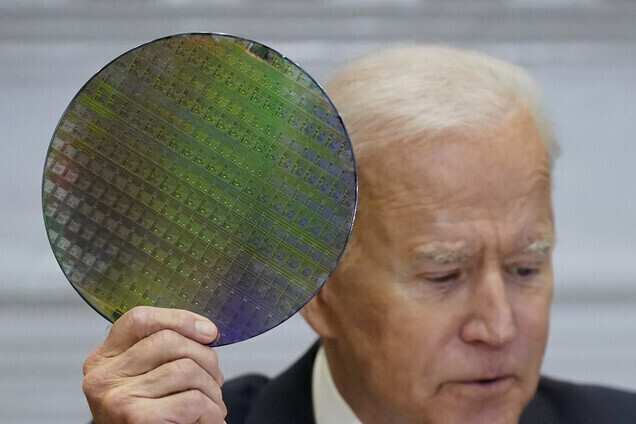

Amid predictions that US President Joe Biden may present an additional sanctions bill in the first half of 2021 to block China’s rise in the area of semiconductors, South Korean semiconductor experts remained cautious about the possibility of the US adopting the kind of intensive sanctions that some are calling for, including a possible ban on exports to China.

In a summit at the White House on Friday, Biden and Japanese Prime Minister Yoshihide Suga shared a consensus on security issues and the need to contain China, including stronger cooperation on the semiconductor supply chain and other technology-related areas.

Biden had previously stressed the importance of the semiconductor supply chain competition with China in an April 12 video conference organized with Samsung Electronics and other major global businesses on the issue of semiconductor supply shortages.

On this basis, observers have been predicting an additional bill for China sanctions could be presented around June 6, when global supply chain reviews are completed for four key areas — semiconductors, batteries, rare earth elements and pharmaceuticals — following an executive order by Biden last February.

But South Korean experts said the Biden administration is unlikely to pursue an all-out push to bar all companies in China from introducing advanced semiconductor equipment. With China already representing a mainstay market for semiconductor companies in the US and elsewhere globally, intensified sanctions against China could harm US businesses.

For instance, China is reported to account for around 30% of the world’s applied materials market.

“In the area of system semiconductors, companies in the US, the Netherlands and Japan control 70% of global equipment exports. The US is going to have a tough time restricting the activities of its own competitive companies without rational or justifiable grounds,” said Association for Advanced Semiconductor Industry chairperson Roh Hwa-wook in a telephone interview with the Hankyoreh.

This analysis and forecast are rooted in a structure in which greater pressure on China by the Biden administration has ripple effects to extend to US companies.

Indeed, an examination of changes in US trade with China shows that while the scale of trade and China’s proportion of it diminished after the US stepped up its onslaught in 2016, that decline slowed or reversed during 2020.

For example, while China’s proportion of imports fell from 21.1% in 2016 to 18.1% in 2019, it bounced back up 0.5 percentage points to 18.6% in 2020. A similar situation was seen in exports to China.

Analysts also said South Korean businesses were unlikely to suffer a major hit even if the controls on exports of components and equipment currently applied to Huawei and other blacklisted businesses are expanded to include all businesses in China.

South Korean semiconductor equipment businesses are not actively exporting to China or other countries overseas due to a lack of technological capabilities. Additionally, the mainstay items produced by Samsung Electronics and SK Hynix are not the system semiconductors that the US is focusing its attention on due to “national security” concerns.

“What the US is looking to invest in now is manufacturing infrastructure for advanced system [non-memory] semiconductors, which have an impact in security terms,” explained Ahn Ki-hyun, senior executive director of the Korea Semiconductor Industry Association.

“The memory semiconductors being produced at Samsung Electronics and SK Hynix plants in China are all-purpose and have nothing to do with security issues,” he said. This means that even if the US does opt for more intensive tactics, the likelihood of them directly impacting South Korean businesses is slim.

But the possibility of additional “low-intensity” sanctions does appear to remain alive. In addition to the recent US-Japan summit, the issue of reorganizing supply chains in the four key areas is also expected to come up at a South Korea-US summit scheduled for next month.

“Since the Barack Obama administration, there’s been a current in the US where they feel they have to stop China from overtaking them in the area of semiconductors at all costs,” said Kim Yang-paeng, a senior researcher at the Korea Institute for Industrial Economics & Trade.

“With President Biden’s executive order and White House meeting for a global supply chain review, there’s been a nuance of ‘we have to keep China in check,’” he added.

“From the US’ standpoint, [blocking exports to China] is quite a high-level measure. If that happens, it basically spells a full-scale technology war between the US and China,” he said.

By Sun Dam-eun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1Why Kim Jong-un is scrapping the term ‘Day of the Sun’ and toning down fanfare for predecessors

- 2After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 3Two factors that’ll decide if Korea’s economy keeps on its upward trend

- 4‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 5AI is catching up with humans at a ‘shocking’ rate

- 6Noting shared ‘values,’ Korea hints at passport-free travel with Japan

- 746% of cases of violence against women in Korea perpetrated by intimate partner, study finds

- 8Why Korea shouldn’t welcome Japan’s newly beefed up defense cooperation with US

- 9Amnesty notes ‘erosion’ of freedom of expression in Korea in annual human rights report

- 10Ethnic Koreans in Japan's Utoro village wait for Seoul's help