hankyoreh

Links to other country sites 다른 나라 사이트 링크

Toshiba announces plans to liquidate NuGen, operator of nuclear power plant in England

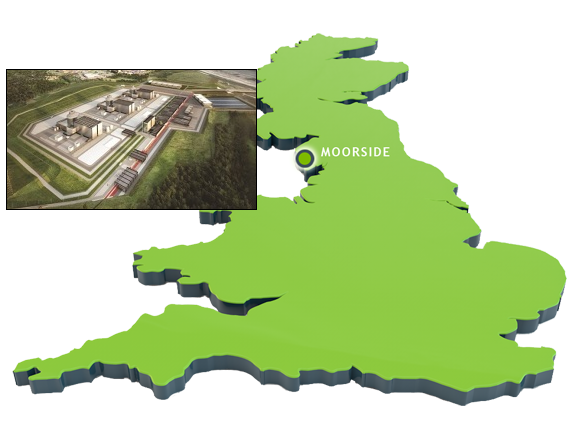

Parent company Toshiba has decided to liquidate NuGen, the operator of the Moorside nuclear power plant project in England, which the Korean Electric Power Corporation (KEPCO) had previously announced its intent to acquire, it was announced on Nov. 8.

With Toshiba now out of the picture, KEPCO and the British government are expected to conduct joint research and negotiations through the first half of next year on the conditions for the Moorside nuclear power project.

According to accounts from KEPCO and Ministry of Trade, Industry and Energy (MOTIE) officials, Toshiba recently decided to undertake large-scale restructuring including the liquidation of NuGen after struggling with financial problems due to stagnant semiconductor performance and the bankruptcy of its US nuclear power affiliate Westinghouse. Toshiba previously stated NuGen’s sale as its priority goal for the 2018 accounting year, but adopted for the liquidation as that failed to pan out as hoped.

In December, Toshiba named KEPCO as a priority negotiation partner for the NuGen sale – shortly after KEPCO had announced its intent to acquire the effectively bankrupt operator. But as deliberations drew out between KEPCO and the British government over the project conditions, Toshiba moved to pressure KEPCO in August by removing its priority negotiation partner designation. It went on to explore possible sales of NuGen to the Canadian company Brookfield and China’s state-run China General Nuclear Power Group (CGN). After that avenue failed to yield results, Toshiba concluded NuGen’s liquidation value outweighed its going concern value.

KEPCO remains a strong candidate to operate Moorside even after NuGen’s liquidation. The British government has held deliberations with KEPCO for almost a year on the conditions for the Moorside project. The British government originally insisted on a contract for difference (CFD) arrangement where KEPCO would pay 22 trillion won (US$19.6 billion) in construction costs to build the plant, which it would then recover through profits from its operation. For KEPCO, this approach was seen as unlikely to ensure stable profits. Recently, joint research has begun toward fleshing out a regulated asset base (RAB) model in which the British government would bear part of the project costs while sharing in profits from power sales.

Some analysts suggested the NuGen liquidation may actually give KEPCO more time to weigh the profitability of the Moorside project before it makes a decision. Now that it is not under pressure from Toshiba to acquire NuGen, it is no longer in any rush in its negotiations with the British government.

“My understanding is that the research and negotiations between the British government and KEPCO to decide the RAB model structure are set to finish in the first half next year,” an industry source said.

“Once the Moorside nuclear power plant project rights have been recovered by the British government, it could begin selecting a new operation sometime around the second half of next year,” the source predicted.

“But with the joint research having already taken place, KEPCO is very likely to be selected as an operator.”

By Choi Ha-yan, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’ [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0510/5217153290112576.jpg) [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

[Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’![[Editorial] Yoon’s gesture at communication only highlights his reluctance to change [Editorial] Yoon’s gesture at communication only highlights his reluctance to change](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0510/7717153284590168.jpg) [Editorial] Yoon’s gesture at communication only highlights his reluctance to change

[Editorial] Yoon’s gesture at communication only highlights his reluctance to change- [Editorial] Perilous stakes of Trump’s rhetoric around US troop pullout from Korea

- [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- [Column] The state is back — but is it in business?

- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

Most viewed articles

- 1[Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

- 2[Editorial] Yoon’s gesture at communication only highlights his reluctance to change

- 3Yoon rejects calls for special counsel probes into Marine’s death, first lady in long-awaited presse

- 4Korea likely to shave off 1 trillion won from Indonesia’s KF-21 contribution price tag

- 5[Book review] Who said Asians can’t make some good trouble?

- 6Nuclear South Korea? The hidden implication of hints at US troop withdrawal

- 7[Column] “Hoesik” as ritual of hierarchical obedience

- 8Young Koreans vent rage over working hours already all too grueling

- 9When and why did Koreans go from anti-American to pro-US?

- 10Birth of Jesus in Korea