hankyoreh

Links to other country sites 다른 나라 사이트 링크

“Trying to work miracles”: S. Korea scours the globe for enough urea to last until new year

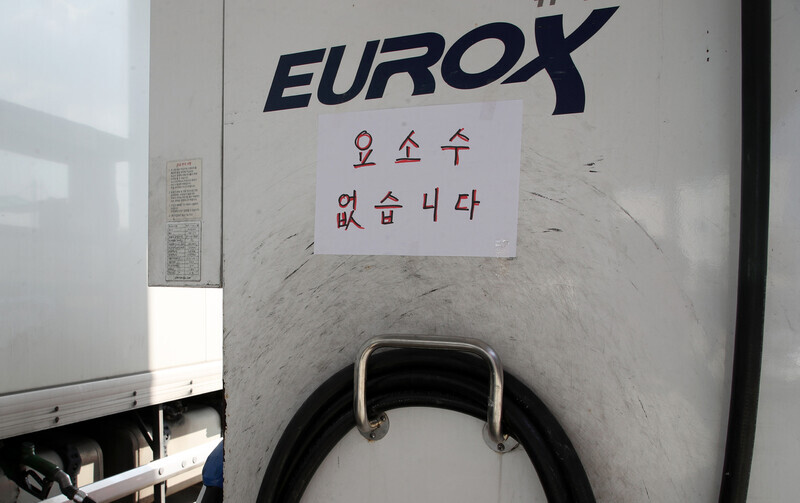

The South Korean government is belatedly scrambling to find alternative supplies of urea water solution in a full-scale response to the substance’s current scarcity.

Seoul has been making gradual progress on securing alternative supplies. Having previously made arrangements to fly in 27,000 liters of the solution from Australia by military transport aircraft, it is now in the final stages of negotiations with Vietnam and other countries to import around 10,000 tons of urea.

But some analysts have criticized this approach as involving too much legwork — missing the forest for the trees. The government has also struggled to acquire numbers that would offer a picture of global trends in the urea market, including production sites, production volumes and export scale.

10,000-ton contract offers possible breathing roomThe South Korean government held a pan-governmental response meeting on urea water solution supplies on Monday at the Government Complex - Seoul.

During the meeting, it was announced that a deal had been finalized to import 200 tons of urea for use in diesel vehicles from Vietnam sometime next week. The government also made public ongoing negotiations with Vietnam and other countries to import 10,000 tons of urea — enough to produce 32.5 million liters of urea water solution.

“If a contract is signed for 10,000 tons of [automobile-use] urea, that would mean enough urea water solution to last about a month and a half,” said an anonymous source at one South Korean company that manufactures urea water solution. That suggests such a contract would keep a major crisis of urea water solution scarcity at bay through the end of the year.

But a government official said, “The ‘10,000 tons’ figure is an amount that is still under negotiation.”

“At present, we can’t make any predictions about when it might arrive or what the [final] volume will be,” they added.

This was the first mention of alternative urea sources being established since the government’s recent creation of a task force presided over by the Blue House policy chief. The government also said a decision had been made to import another 7,000 liters of urea water solution from Australia on top of the 20,000 liters originally planned for.

Plans for tax support were also shared Monday. Most notably, they involved lowering the tariff rate to zero from its current level of 5%–6.5%.

Without tariffs, South Korean import companies can acquire urea from overseas at lower prices. But with global urea prices soaring over the past few months, it is unclear just how much this will do to bring in more urea.

First Vice Minister of Economic and Finance Lee Eog-weon said, “Until the situation stabilizes, we’ll be holding daily review meetings for the time being to monitor trends in urea and urea water solution supplies while actively exploring all necessary measures.”

Who has urea?The government’s hunt for alternative urea sources is happening at the level of individual overseas companies. Some critics have likened the approach to “missing the forest for the trees.”

Difficulties in parsing production volumes in different countries and other information are to blame. Both the Ministry of Trade, Industry and Energy (MOTIE) and the Ministry of Economy and Finance (MOEF) told the Hankyoreh that no overall data had been acquired on urea production or trade.

Information compiled by private organizations can be used to provide a general picture of different countries’ imports and exports of urea, including the agricultural variety.

In its review of data from the New York-based data tech company Knoema, the Hankyoreh found that the most urea exports in 2019 came from Russia (6.98 million tons), followed by Qatar (5.13 million), China (4.94 million), Egypt (4.41 million), and Saudi Arabia (3.17 million). Together, those five countries accounted for 56.5% of global urea exports that year.

As recently as 2015, China was the world’s top urea exporter, with exports of nearly 14 million tons. Since then, that volume has declined considerably, reaching around 2 million tons in 2018.

The Food and Agriculture Organization of the UN (FAO) also compiles urea statistics based on surveys of individual countries. Its report showed the major urea producers as of 2019 to be India (24.46 million tons), Russia (8.63 million), Indonesia (7.72 million), Pakistan (6.17 million), and the US (6.13 million). While China is also seen as a major producer, it did not reply to the FAO survey, which means the report could not provide any information on its urea production levels.

KOTRA to the rescue once againThe work of securing alternative urea import sources has fallen on the Korea Trade-Investment Promotion Agency (KOTRA). With trade offices operating around the world, KOTRA is one of the most well-versed government or government-related institutions when it comes to overseas industry conditions.

The task of finding alternative sources was dropped on KOTRA on Thursday, Nov. 4 — about three weeks after China announced its restrictions on urea exports.

Speaking on condition of anonymity, a KOTRA official said, “Right after we got the request from the MOTIE to find alternative sources, the [KOTRA] export support center issued orders for KOTRA’s various trade offices around the world to locate them.”

KOTRA also took action to find alternative import sources in 2018 when Japan imposed measures restricting the exports of semiconductor materials. This means it has some experience with locating alternative sources for scarce materials.

Another KOTRA official said, “The different trade offices have been looking around everywhere trying to work miracles [in tracking down alternative urea sources].”

“The volumes aren’t adequate yet, but we have already acquired some new sources and reported them to the government,” the official added.

But neither KOTRA nor the MOTIE — which received KOTRA’s reports — would disclose the specific volumes and sources, explaining that it would put South Korea at a disadvantage in volume and price negotiations if the new sources were made public.

By Kim Kyung-rak and Lee Ji-hye, staff reporters

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?![[Column] Life on our Trisolaris [Column] Life on our Trisolaris](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0505/4817148682278544.jpg) [Column] Life on our Trisolaris

[Column] Life on our Trisolaris- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

Most viewed articles

- 160% of young Koreans see no need to have kids after marriage

- 2[Column] Life on our Trisolaris

- 3New sex-ed guidelines forbid teaching about homosexuality

- 4Presidential office warns of veto in response to opposition passing special counsel probe act

- 5How daycares became the most viable business for the self-employed

- 6OECD upgrades Korea’s growth forecast from 2.2% to 2.6%

- 7Amid US-China clash, Korea must remember its failures in the 19th century, advises scholar

- 8Months and months of overdue wages are pushing migrant workers in Korea into debt

- 9[Column] The state is back — but is it in business?

- 10[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis