hankyoreh

Links to other country sites 다른 나라 사이트 링크

Clouds of recession gathering over South Korean economy

By Noh Hyun-woong and Choi Hyun-june, staff reporters

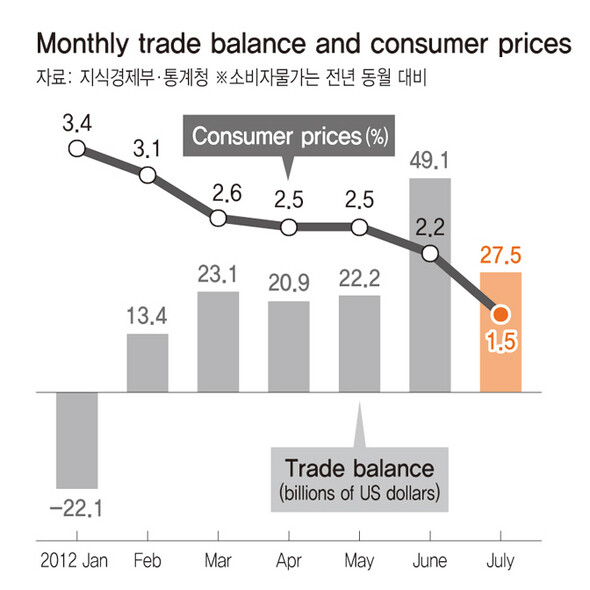

Economic data issued separately on August 1 by the Ministry of Knowledge Economy (MKE) and Statistics Korea paint a fairly rosy picture of a positive trade balance and tapering inflation. But a closer look shows something much less encouraging. With external factors like the Eurozone crisis and China’s economic slump still very much in play, the shadow of recession hangs heavily over the South Korean economy.

To start with, there are clear signs of a drop in the exports that are so important. On July 7, the MKE put total exports at US$44.6 billion. This was down 8.8% from the same month in 2011, the biggest slide since the 8.5% recorded in October 2009.

Particularly troubling is the across the board contractions for the country’s export mainstays: ships, LCD displays, general machinery, petrochemicals, steel, and cars. Cumulative exports as of July were also down 0.8% from last year.

Another worrying development is the drop in imports. Last month’s total of $41.9 billion was down 5.5% from the year before. The balance of trade was in the black at US$2.75 billion, its sixth straight month in the positive column since February, but signs of a recession-type surplus, where both exports and imports drop, are increasingly apparent. Since South Korean industries import most of their raw materials and export processed materials, a dip in imports indicates a likely export slump.

“Given the ongoing uncertainty in domestic and overseas economic conditions, this drop-off in exports is likely to continue for the time being,” predicted Shin Seung-kwan, chief trend analyst for the Korea International Trade Association’s Institute for International Trade.

Signs of recession were also evident in consumer price trends. Statistics Korea released a report on July consumer price trends on August 1 that showed their rate of increase to be up 1.5% from the same month in 2011. This was the lowest rise in the twelve years since May 2000, when the level was 1.1%.

A major reason for the blunted level is the baseline effect, given the 4.5% rate recorded in July 2011. Also affecting the number on the supply side were the stabilization of oil (-0.7%) and farming and fishing product costs (1.5%), both of which can upset prices.

But many analysts also said reduced consumption amid recession conditions removed some of the upward pressure on prices.

“We’re not in the thick of it yet, but we’re starting to see reflections of the deteriorating economic conditions and a resulting drop in demand,” said Lim Hee-jung, chief of the real economy team at the Hyundai Research Institute.

Indeed, the rate of increase in core prices for industrial products and services has been falling continuously for the past seven months. After clocking in at 3.6% in December, it dropped to 1.2% in July.

The core price index examines changes in prices for select demand-sensitive items that show little price variation, providing a clear picture of consumer mind-sets.

Noting that both corporate investment and consumption have dropped off recently, LG Economic Research Institute research fellow Lee Geun-tae said, “It looks like suppliers haven’t been able to raise their industrial product or service prices in the face of declining consumption.”

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/9417144634983596.jpg) [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis![[Column] Can Yoon steer diplomacy with Russia, China back on track? [Column] Can Yoon steer diplomacy with Russia, China back on track?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/1617144616798244.jpg) [Column] Can Yoon steer diplomacy with Russia, China back on track?

[Column] Can Yoon steer diplomacy with Russia, China back on track?- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

Most viewed articles

- 1Under conservative chief, Korea’s TRC brands teenage wartime massacre victims as traitors

- 2Months and months of overdue wages are pushing migrant workers in Korea into debt

- 3[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 4[Column] Can Yoon steer diplomacy with Russia, China back on track?

- 5After election rout, Yoon’s left with 3 choices for dealing with the opposition

- 6First meeting between Yoon, Lee in 2 years ends without compromise or agreement

- 7[Column] Behind factional animus of Korean politics, victim mentality festers

- 8‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 9[Editorial] Japan’s removal of forced labor memorial tramples on remembrance, reflection and friends

- 10[Guest essay] A society in which old age becomes a burden