hankyoreh

Links to other country sites 다른 나라 사이트 링크

OECD’s digital taxation may expand to target all multinationals

Samsung Electronics, LG Electronics, Hyundai Motor, and other South Korean companies operating internationally are facing an increased likelihood of being subject to digital taxation, or the so-called “Google tax.” While the debate over digital taxation initially targeted online-based global businesses like Google and Facebook that operate across national borders, it is now shifting amid pressure from the US toward the taxation of multinationals producing consumer goods. Depending on what kind of agreement is reached, South Korea’s large corporations could also face a heavier tax burden.

With the deadline for a digital tax agreement looming in late January of next year, the world’s major economies are expected to wage a heated contest to protect their own industries and economies and defend their national tax revenues. Indeed, South Korea set up a task force in March of this year to work on its own response plan.

According to an explanation from the Ministry of Economy and Finance (MOEF) on Oct. 30, the OECD proposed two main digital tax approaches early this month based on its coordination of the various countries’ interests: a “unified approach” intensifying taxation authority for countries where markets operate, and a “global minimum tax” to prevent tax evasion.

Under the unified approach, not only multinational IT companies but also multinationals doing business with consumers -- including makers of smartphones, appliances, and automobiles -- would be subject to digital taxation. This reflects the US government’s insistence that companies selling consumer goods should also be subject to the taxes amid concerns that US companies like Google and Facebook would bear all the brunt if digital taxes are introduced under the framework currently being discussed. The logic behind taxation under the unified approach is that manufacturers also use social media and online markets for marketing and value generation, which makes them no different from IT companies in terms of digital business. If this approach is followed, South Korean corporations like Samsung Electronics, LG Electronics, and Hyundai Motor would also be subject to taxation.

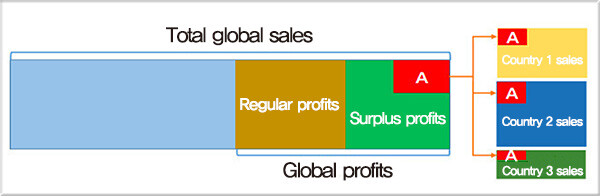

Current corporate taxes are paid only to the country where a business has a corporate headquarters or other kind of fixed workplace. Under the unified approach, taxes on profits earned from consumers in different countries are to be distributed among the countries in the regions where sales occur rather than being kept by the country where the parent company is located.

The taxation method currently being discussed for the unified approach involves classifying multinationals’ profits into “regular” and “surplus” types, with taxes being imposed on a portion of surplus profits by the country in which sales occurred based on its own corporate tax rate. Regular profits are seen as those arising from tangible assets, while surplus profits are viewed as those arising from the use of intangible assets. For instance, consider an agreement scenario in which a country where sales occur possesses taxation authority for 10% of surplus profits. If Samsung Electronics earns 10 trillion won (US$8.61 billion) in surplus profits, the country where sales occurred could impose corporate taxes on 10% of that. In a case where 10 different countries (e.g., South Korea, China, and Japan) account for identical sales, each of those 10 countries would then have the right to tax one-tenth of the US$8.61 billion. Since different countries have different corporate tax rates, a company like Samsung could face a higher total tax burden if a large proportion of its sales come in a country with a high corporate tax rate than if it only paid taxes on the US$8.61 billion total in South Korea, where its headquarters are located.

From the South Korean government’s standpoint, this could translate into a drop in revenues as a portion of the taxes it collected from Samsung go to other countries instead. Conversely, the South Korean government would have the authority to tax Google’s sales in South Korea, and the question of whether revenues increase or decrease would be determined by the standards applied.

“From our standpoint, maximally ensuring the national interest will require us to negotiate something where South Korean companies pay fewer taxes overseas, while we impose heavier taxes on IT companies like Google,” said Kim Jeong-hong, director of the MOEF international tax system division.

Also being discussed is the introduction of a “global minimum tax” requiring the payment of a certain minimum level of taxes to prevent tax evasion -- an issue that cannot be resolved by the unified approach alone. The measure is intended to prevent multinationals from paying less in corporate taxes by misrepresenting themselves as earning more of their income in countries with low corporate tax rates.

Final agreement to be reached in late January of next yearThe OECD plans to hold hearings on the unified approach and global minimum tax in November and December, respectively. A final agreement is to be reached in late January of next year at a general meeting of the OECD/G20 Inclusive Framework, a consultative framework to respond to tax evasion. But with the report containing the agreement scheduled for publication in late 2020 and subsequent efforts needed for the establishment of related norms, the South Korean government is predicting another three or four years will be needed before its actual implementation.

By Lee Kyung-mi, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0507/7217150679227807.jpg) [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

Most viewed articles

- 1[Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- 2Yoon’s broken-compass diplomacy is steering Korea into serving US, Japanese interests

- 360% of young Koreans see no need to have kids after marriage

- 4After 2 years in office, Yoon’s promises of fairness, common sense ring hollow

- 5[Column] Why Korea’s hard right is fated to lose

- 6S. Korean first lady likely to face questioning by prosecutors over Dior handbag scandal

- 7[News analysis] Jo Song-gil’s defection and its potential impact on inter-Korean relations

- 8[Column] “Hoesik” as ritual of hierarchical obedience

- 9Amid US-China clash, Korea must remember its failures in the 19th century, advises scholar

- 1011 years after US decamped, military base in Busan still festering with pollution