hankyoreh

Links to other country sites 다른 나라 사이트 링크

Samsung Electronics sees operating profits drop by half in 2019

Samsung's operating profits in 2019 were 27.77 trillion won (US$23.37 billion), a 52.84% decrease from the previous year. While Samsung's main business of semiconductors experienced a boom in 2018, this was replaced by a slump in 2019 due to a decreased demand for semiconductor memory. However, with signs of recovery showing in the beginning of last year's fourth quarter, many believe that "things can only go up from here."

On Thursday, Samsung reported 230.4 trillion won (US$193.91 billion) in revenue, and 27.77 trillion won (US$23.37 billion) in operating profits, in 2019. Revenue and operating profits decreased by 5.48% and 52.84%, respectively.

The semiconductor business had the largest impact on the diminished performance. Thought to be undergoing a "super boom" in 2018, the semiconductor division reported 44.57 trillion won (US$37.51 billion) in operating profits that year, comprising the overwhelming majority of the company's total of 58.89 trillion won (US$49.57 billion) in operating profits in 2018.

Smartphone business produces less than 10 tn won in profits for first time since 2011Along with semiconductors, smartphones -- the second pillar of Samsung Electronics profits -- also made a poor showing. Samsung Electronics' IT and mobile communications division, the unit in charge of smartphones, recorded just 9.37 trillion won (US$7.88 billion) in operating profits last year, breaking its "10 trillion won streak." It was the first time the smartphone business produced less than 10 trillion won (US$8.41 billion) in profits since 2011. Much of this had to do with the failure of the Galaxy S10, Samsung's flagship 2019 product, to meet sales expectations.

The displays unit has not fared much better. Compared to 2018, revenue and operating profits in 2019 each decreased from 118.57 trillion won (US$99.76 billion) to 95.52 trillion won (US$80.36 billion), and 46.52 trillion won (US$39.14 billion) to 15.58 trillion won (US$13.11 billion), respectively.

Only consumer electronics like TVs were relatively unscathed, recording 44.76 trillion won (US$37.67 billion) and 2.61 trillion won (US$2.2 billion) in revenue and operating profits in 2019 -- a modest jump from 42.11 trillion won (US$35.44 billion) and 2.2 trillion won (US$1.85 billion) in 2018.

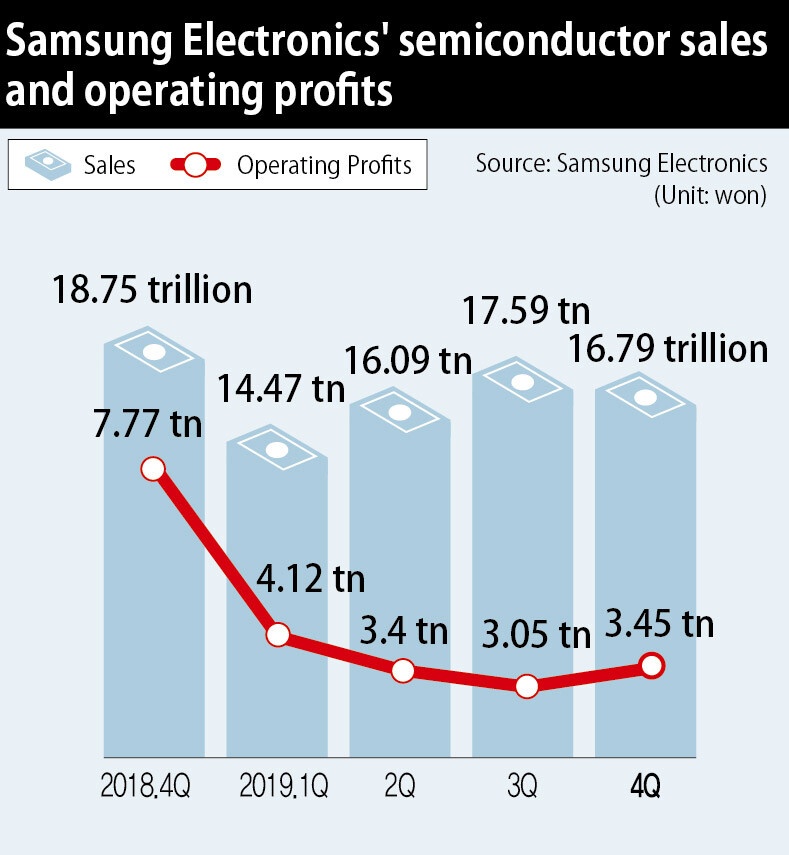

Despite the dismal year, recent currents seem more favorable. Last year's fourth quarter semiconductor revenue and profits were 16.79 trillion won (US$14.13 billion) and 3.45 trillion won (US$2.9 billion), respectively. Compared to the 3.05 trillion won (US$2.57 billion) in operating profits barely attained in the previous quarter, this is a 13.11% increase. After dropping from 7.77 trillion won (US$6.54 billion) in the fourth quarter of 2018 to 4.12 trillion won (US$3.47 billion) and 3.4 trillion won (US$2.86 billion) in the first and second quarters of 2019, semiconductor operating profits appear to be rebounding after hitting rock bottom in the third quarter.

While the market is optimistic that the semiconductor unit’s fortunes will improve this year, Samsung Electronics offered a somewhat cautious forecast during its Thursday conference call. Regarding the high demand for semiconductor memories for data center servers, the company stated, "While there is an observable increase in demand, it is too early to say that we've properly entered the cycle of rebounding demand, so our position is one of cautiousness."

Samsung Electronics predicted that this year's bit growth (the rate of memory capacity increase represented in bits) would be in the mid-10 to 20% range for DRAM, and in the upper-20 to 30% range for NAND flash. Although this year's first quarter (January to March) smartphone revenue has improved due to the expansion of the 5G mobile communications lineup and the additional releases of foldable phones, the company nonetheless predicted that operating profits would be similar to last quarter's on account of increased marketing costs.

On Thursday, Samsung Electronics stock fell 3.21% compared to the previous day. The drop appears to be influenced by the fact that Samsung exhibited a more conservative attitude than the market expected, as well increased uncertainty due to the spread of the novel coronavirus.

By Song Gyung-hwa, staff reporter

Please direct comments or questions to [englisih@hani.co.kr]

Editorial・opinion

![[Editorial] Yoon must halt procurement of SM-3 interceptor missiles [Editorial] Yoon must halt procurement of SM-3 interceptor missiles](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/child/2024/0501/17145495551605_1717145495195344.jpg) [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

[Editorial] Yoon must halt procurement of SM-3 interceptor missiles![[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0430/9417144634983596.jpg) [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

Most viewed articles

- 1Months and months of overdue wages are pushing migrant workers in Korea into debt

- 2Trump asks why US would defend Korea, hints at hiking Seoul’s defense cost burden

- 3[Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- 4At heart of West’s handwringing over Chinese ‘overcapacity,’ a battle to lead key future industries

- 5[Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- 61 in 3 S. Korean security experts support nuclear armament, CSIS finds

- 7Fruitless Yoon-Lee summit inflames partisan tensions in Korea

- 8First meeting between Yoon, Lee in 2 years ends without compromise or agreement

- 9Under conservative chief, Korea’s TRC brands teenage wartime massacre victims as traitors

- 10[Column] Park Geun-hye déjà vu in Yoon Suk-yeol