hankyoreh

Links to other country sites 다른 나라 사이트 링크

Democratic Party pursues regulations to restrict real estate speculation by foreign nationals

The ruling Democratic Party is pursuing legislation to regulate speculative apartment purchasing among foreign nationals, which has been cited as a factor in the recent overheating of the South Korean real estate market.

According to accounts from the National Assembly on Aug. 5, Democratic Party lawmaker Chung Il-young sponsored an amendment to the Local Tax Act that would impose 20% more in acquisition taxes in cases where foreign nationals do not actually take up residence in South Korean properties within six months of purchase. Explaining his proposal, Chung said, “Since there are no regulations for foreign nationals in terms of acquiring housing, we need to eliminate speculative demand and pursue stability in the housing market through an increased acquisition tax.” On July 27, Democratic Party floor leader Kim Tae-nyeon announced plans to “develop countermeasures for speculative real estate purchasing by foreign nationals after examining overseas cases.”

Canada, Australia, Singapore, and other countries have various mechanisms to regulate investment in local real estate by foreign buyers. A report on “overseas examples of real estate purchasing by foreign nationals” drafted late last year by the National Assembly Research Service (NARS) and submitted to the office of then United Future Party lawmaker Hong Chul-ho showed that Canada imposes an acquisition tax equivalent to 20% of acquisition face value for residential real estate purchased by foreign nationals in certain regions, including central Vancouver.

Australia has a foreign investment review committee in place to review whether real estate investment by foreign nationals conflicts with the “national interest.” Foreign nationals must receive the committee’s approval to purchase or rent real estate valued at AUD 50 million (US$36 million) or more. In 2017, the Australian federal government announced plans to revise the real estate taxation structure for foreign purchasers, including barring them from requesting transfer income tax exemptions when disposing of real estate owned in Australia for residential purposes.

Additionally, they are required to pay a withholding tax of 12.5% of the sale amount to the Australian Taxation Office if they cannot prove their status as resident taxpayers when disposing of real estate. In the state of Victoria, foreign buyers are required to pay an additional stamp duty and absentee owner surcharge when purchasing real estate.

In Singapore, foreign buyers pay an acquisition tax amounting 20% of face value when acquiring housing as a measure to stabilize the housing market.

In contrast, foreign nationals in South Korea are able to acquire domestic real estate on more or less the same terms as domestic purchasers. Some have claimed that the recent rise in housing prices has been the result of foreign high rollers “shopping” for local real estate. Indeed, some are even suggesting a situation of reverse discrimination has emerged as recently intensified loan regulations mean that foreign purchasers can skirt South Korean financial regulations by taking out loans in their home country’s banks to buy South Korean real estate.

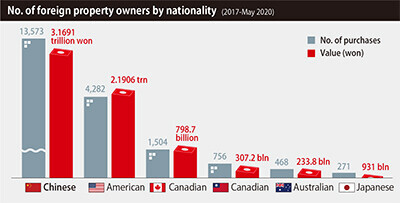

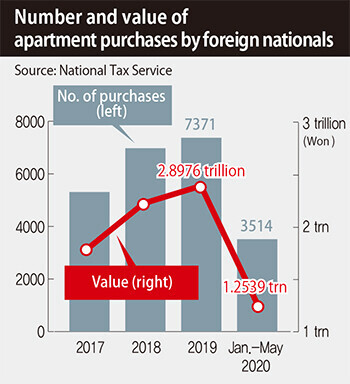

June 2020 saw highest ever number of real estate purchases from foreign buyersAccording to monthly real estate transaction figures from the Korean Appraisal Board (KAB), June saw 2,090 transactions by foreign nationals involving domestic buildings -- the largest number since statistics were first compiled in 2006. A recent National Tax Agency audit uncovered a US national in their 40s who is suspected of tax evasion after purchasing 42 apartments in the past two years through a “gap investing” approach.

With real estate speculation among foreign purchasers emerging as a real issue, the South Korean government has begun examining a possible legislative response. An official with the Ministry of Economy and Finance said, “We plan to examine overseas cases of regulation and consider whether there is any possibility of them being in violation with international agreements.”

By Lee Kyung-mi, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’ [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0510/5217153290112576.jpg) [Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’

[Correspondent’s column] The real reason the US is worried about Chinese ‘overcapacity’![[Editorial] Yoon’s gesture at communication only highlights his reluctance to change [Editorial] Yoon’s gesture at communication only highlights his reluctance to change](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0510/7717153284590168.jpg) [Editorial] Yoon’s gesture at communication only highlights his reluctance to change

[Editorial] Yoon’s gesture at communication only highlights his reluctance to change- [Editorial] Perilous stakes of Trump’s rhetoric around US troop pullout from Korea

- [Guest essay] Preventing Korean Peninsula from becoming front line of new cold war

- [Column] The state is back — but is it in business?

- [Column] Life on our Trisolaris

- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

Most viewed articles

- 1Korea likely to shave off 1 trillion won from Indonesia’s KF-21 contribution price tag

- 2Nuclear South Korea? The hidden implication of hints at US troop withdrawal

- 3[Editorial] Perilous stakes of Trump’s rhetoric around US troop pullout from Korea

- 4With Naver’s inside director at Line gone, buyout negotiations appear to be well underway

- 5In Yoon’s Korea, a government ‘of, by and for prosecutors,’ says civic group

- 6[Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- 7‘Free Palestine!’: Anti-war protest wave comes to Korean campuses

- 8How many more children like Hind Rajab must die by Israel’s hand?

- 9Overseeing ‘super-large’ rocket drill, Kim Jong-un calls for bolstered war deterrence

- 10[Photo] ‘End the genocide in Gaza’: Students in Korea join global anti-war protest wave