hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea semiconductor firms rush to expand non-memory sector

South Korean semiconductor firms are speeding up efforts to expand their portfolio from semiconductor memory such as DRAM and NAND flash to the non-memory sector, including the foundry model of manufacturing semiconductors on commission. SK Hynix has “reinvested” in a foundry division that it spun off in the past, while Samsung Electronics is planning to bolster its investment with the goal of becoming the number one firm not only in semiconductor memory but also in the non-memory sector.

According to SK Hynix’s 2019 business report, released on Mar. 31, its non-memory sales last year amounted to around 800 billion won (US$646.9 million), over 250 billion won (US$202.2 million) higher than the previous year. The company posted 20.3 trillion won (US$16.42 billion) in sales of DRAM, a kind of semiconductor memory, down 37% from the previous year, while its NAND flash sales, at 5.1 trillion won (US$4.12 billion), fell by 31% during the same period. Sales crashed as the semiconductor memory sector bottomed out last year. As a consequence, DRAM’s share of sales fell from 80% to 75% in 2019, despite this being one of the company’s main products.

While its non-memory division is still in its initial phase, SK Hynix plans to focus on expanding it this year. One goal is to find a new source of profit; another is to spread out the risk resulting from industry volatility by diversifying a business structure that has leaned heavily on semiconductor memory.

The expansion of 5G communication networks and growth in the AI industry are driving expectations of an even bigger boom in the non-memory sector. SK Hynix is pinning a lot of hopes on a foundry located in the Chinese city of Wuxi, which is supposed to be completed at the end of June. Construction on the factory was launched in 2018 through a joint venture with the city government, and the factory ran a successful production test in mid-March. “We’re planning to begin mass production by the end of the year,” a company spokesperson said.

SK Hynix is also spending big bucks on indirect investment in the non-memory sector. On Mar. 31, it agreed to put down US$174 million to participate indirectly, as a limited partner, in “Fab 4,” the Cheongju factory of MagnaChip, a firm specializing in non-memory devices. That gives the company a 49.8% share in a consortium set up by private equity firms Credian Partners and Alchemist Capital Partners, which are planning to buy MagnaChip’s Cheongju factory. The majority investor in the consortium (holding a 50% share plus one share) is the Korean Federation of Community Credit Cooperatives (Saemaeul Geumgo). MagnaChip was spun off from SK Hynix (then known as Hynix Semiconductor) in 2004.

“We decided to join [the consortium] in consideration of the mid- and long-term growth potential,” a company spokesperson remarked.

This year is also important for Samsung Electronics, which has a head start in the non-memory market. Last year, Samsung announced that it would be investing a total of 133 trillion won (US$107.55 billion) toward its goal of becoming number one in the world in system semiconductors by 2030, and this year is when that investment is slated to begin.

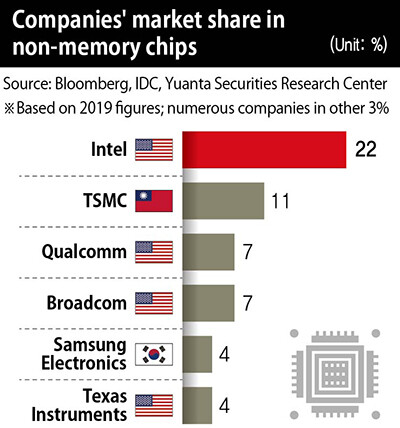

Samsung Electronics already ranks second in the global foundry market, after the Taiwan Semiconductor Manufacturing Company (TSMC), but it has a lot of catching up to do. On Mar. 20, market research firm TrendForce estimated that Samsung Electronics held a 15.9% market share in the first quarter of this year, while placing TSMC, the top firm, at 54.1%. In the non-memory sector overall, Samsung Electronics has a market share of about 4%.

“Since releasing its ‘2030 vision,’ Samsung Electronics has reorganized its foundry business into a separate division and has been focusing investment on extreme ultraviolet (EUV) lithography. If Samsung can increase its market share in the foundry market to 40%, its share in the total non-memory market would rise to 10%,” Yuanta Securities Korea said in a report published on Mar. 16.

“At the end of this year, Samsung Electronics is expected to switch over from DRAM 30K to CMOS Image Sensors [CIS] 20K,” Yuanta added. CIS is a non-memory device.

By Song Gyung-hwa, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Season 2 of special prosecutor probe may be coming to Korea soon [Column] Season 2 of special prosecutor probe may be coming to Korea soon](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0426/3317141030699447.jpg) [Column] Season 2 of special prosecutor probe may be coming to Korea soon

[Column] Season 2 of special prosecutor probe may be coming to Korea soon![[Column] Park Geun-hye déjà vu in Yoon Suk-yeol [Column] Park Geun-hye déjà vu in Yoon Suk-yeol](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0424/651713945113788.jpg) [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

[Column] Park Geun-hye déjà vu in Yoon Suk-yeol- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

- [Column] ‘Choson’: Is it time we start referring to N. Korea in its own terms?

- [Editorial] Japan’s rewriting of history with Korea has gone too far

- [Column] The president’s questionable capacity for dialogue

- [Column] Are chaebol firms just pizza pies for families to divvy up as they please?

- [Column] Has Korea, too, crossed the Rubicon on China?

- [Correspondent’s column] In Japan’s alliance with US, echoes of its past alliances with UK

Most viewed articles

- 1‘We must say no’: Seoul defense chief on Korean, USFK involvement in hypothetical Taiwan crisis

- 2Is Japan about to snatch control of Line messenger from Korea’s Naver?

- 3No good, very bad game for Korea puts it out of Olympics for first time since 1988

- 4Samsung subcontractor worker commits suicide from work stress

- 5[Editorial] Korea’s surprise Q1 growth requires objective assessment, not blind fanfare

- 6Division commander ordered troops to enter raging flood waters before Marine died, survivor says

- 7N. Korean delegation’s trip to Iran shows how Pyongyang is leveraging ties with Moscow

- 8Korea’s 1.3% growth in Q1 signals ‘textbook’ return to growth, says government

- 9Flying “new right” flag, Korea’s Yoon Suk-yeol charges toward ideological rule

- 10[Column] Park Geun-hye déjà vu in Yoon Suk-yeol