hankyoreh

Links to other country sites 다른 나라 사이트 링크

[News analysis] SK Hynix acquires Intel’s NAND unit on way to becoming world’s 2nd biggest flash memory chipmaker

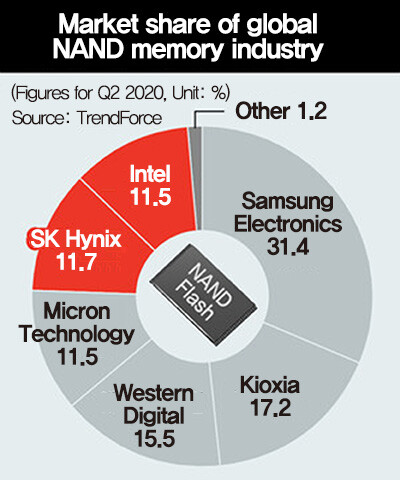

SK Hynix’s acquisition of Intel’s memory semiconductor (NAND flash) unit is a literal “big deal” that will mean changes to both the global semiconductor industry and the South Korean business world. The acquisition propels Hynix to second place globally in both the DRAM and NAND flash markets. Previously hot on the Hyundai Group’s heels, the SK Group stands a very good chance of shooting straight up to second place in the South Korean corporate hierarchy with this deal.

Background behind the ‘big deal’At 10.3 trillion won (around US$9 billion), the acquisition is the largest in the history of South Korean mergers and acquisitions (M&A). The previous record had been the 9.3 trillion won (US$8.21 billion) spent by Samsung Electronics in 2017 to acquire a US automotive electronics company. The reason for the deal lies in the perfect fit between both SK Hynix and Intel’s interests. SK Hynix is highly dependent on DRAM, which represents over 70% of its sales. By its nature, the DRAM market experiences large periodic ebbs and flows, and SK Hynix’s performance has fluctuated sharply. The situation was one that demanded a business portfolio adjustment.

Explaining the background behind the deal in a message sent to SK Hynix employees the same day, CEO Lee Seok-hee said, “We got off to a bit of a late start with the NAND unit, and it hasn’t been easy overcoming the late-starter handicap.”

Kim Sun-woo, an analyst with Meritz Securities, said, “SK Hynix’s Intel acquisition means there will be fewer suppliers in the NAND market, which increases bargaining strength. SK Hynix will also be able to achieve economies of scale with a 20% market share.”

Despite its reputation as one of the world’s leading semiconductor companies, Intel has been seen as relatively lacking in technology competitiveness in its non-memory projects. This created a situation where it needed to focus more of its capacities on those non-memory areas. Amid a greater onslaught than ever this year from late starters like Nvidia with their non-memory semiconductor technology, observers had begun talking about a “crisis” for Intel. At a time when the COVID-19 pandemic was driving an expansion in untact (non-face-to-face) services that had other semiconductor companies basking in a “premium,” Intel share prices were plummeting. The company has already fallen behind Nvidia in terms of market capitalization. In effect, Intel’s choice to sell off its memory unit was intended as a way of breaking through its crisis.

Repercussions for the business worldWith this deal, the SK Group has leaped to the threshold of second place in the South Korean business world hierarchy. In terms of total (fair) assets, SK was nipping at the Hyundai Group’s heels as of late last year, with a difference of around 9 trillion won (US$7.95 billion). An SK senior official said, “According to the contract, if the deal is approved by our respective governments next year, there is to be an initial payment of US$7 billion out of the US$9 billion total, with the balance to be paid in 2025, when the deal concludes.”

“Ownership of Intel’s assets will also change with the payment timeline,” the official explained. This means a very good chance that the SK Group will rise to second place in the business world hierarchy by as early as late 2021. The Intel assets that are being purchased total just over 7.8 trillion won (US$6.89 billion).

The SK Group has grown through the most aggressive approach to M&A activity among South Korea’s major chaebol groups. It stands in contrast with the way most others groups have first established companies through investment and then diversified their projects. It is only within the last two to three years that South Korean chaebol groups have begun pursuing M&A in earnest. In SK’s case, the latest transaction comes on the heels of its 2012 acquisition of SK Hynix for 3 trillion won (US$2.65 billion) -- meaning it has turned the semiconductor industry into a key group focus in a period of less than 10 years. This contrasts with Samsung Electronics, which has spent over 30 years cultivating a semiconductor industry.

“The past few years have brought rapid changes to the industry environment, and there’s been a noticeable increase in M&A activity by corporations looking for new sustenance,” said a business world source closely acquainted with the situation among the major groups.

“We could see this kind of phenomenon happening a lot, where the business world environment is rocked by things like big deals that shake up the rankings,” the source predicted.

On the stock market that day, SK Hynix shares closed at 85,200 won (US$75.26), down 1,500 won (US$1.33, or 1.73%) from the day before. After briefly rising by as much as 2,700 won (US$2.39) early on in trading, performance remained weak throughout the day.

By Koo Bon-kwon, senior staff writer

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0517/8117159322045222.jpg) [Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later

[Editorial] Intensifying US-China rivalry means Seoul must address uncertainty with Beijing sooner than later![[Column] When ‘fairness’ means hate and violence [Column] When ‘fairness’ means hate and violence](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0516/7417158465908824.jpg) [Column] When ‘fairness’ means hate and violence

[Column] When ‘fairness’ means hate and violence- [Editorial] Yoon must stop abusing authority to shield himself from investigation

- [Column] US troop withdrawal from Korea could be the Acheson Line all over

- [Column] How to win back readers who’ve turned to YouTube for news

- [Column] Welcome to the president’s pity party

- [Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- [Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- [Column] Will Seoul’s ties with Moscow really recover on their own?

- [Column] Samsung’s ‘lost decade’ and Lee Jae-yong’s mismatched chopsticks

Most viewed articles

- 1[Editorial] Transfers of prosecutors investigating Korea’s first lady send chilling message

- 2[Column] US troop withdrawal from Korea could be the Acheson Line all over

- 3[Column] When ‘fairness’ means hate and violence

- 4China calls US tariffs ‘madness,’ warns of full-on trade conflict

- 5Major personnel shuffle reassigns prosecutors leading investigations into Korea’s first lady

- 6[Editorial] Yoon must stop abusing authority to shield himself from investigation

- 7Could Korea’s Naver lose control of Line to Japan?

- 8[Editorial] Korea must respond firmly to Japan’s attempt to usurp Line

- 9US has always pulled troops from Korea unilaterally — is Yoon prepared for it to happen again?

- 10[Column] Welcome to the president’s pity party